EUR watch: Why the ECB outlook is 100% off in 4 charts

The ECB hiked as we anticipated and the EUR weakened materially alongside a dovish re-pricing of EUR rates. Smack dab at our forecast and positioning, but is the ECB outlook fair at this point? We find the updated staff projections amusing to say the least and hence also struggle to understand current market pricing of the ECB relative to peers.

This sentence was added to the ECB press release:

“Based on its current assessment, the Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the return of inflation to the target.”

This is by far the closest to outright admitting to pausing that any G10 central bank has gotten. The ECB is closer to actually pausing than the Fed.

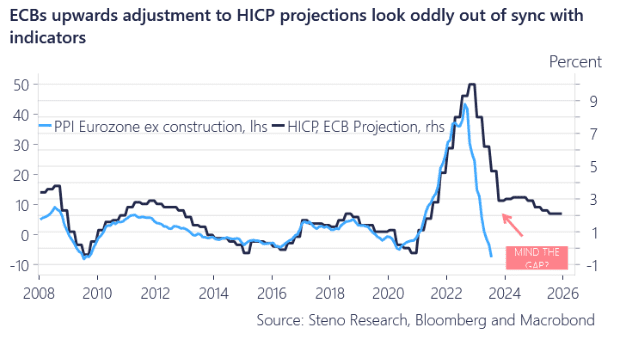

Why are inflation forecasts then hawked up in the September projections? Likely to allow the ECB not to increase them, but rather decrease them at coming meetings, which rhymes better with an actual pause than a scenario where forecasts will have to be revised up.

Chart 1: ECB forecast out sync with simple forward looking evidence

We consider the ECB assumptions to be off and see a much “weaker” ECB commitment going forward compared to the Fed. Here is why the ECB is off in 4 charts!

0 Comments