EUR Liquidity Watch – How well are depositors protected? Italy with the largest bill to pay (again)

Welcome back again to a fairly short article about the ECB and EUR Liquidity, where we try to guide you through some of the more complex mechanisms of the Euro system as well as how it affects markets.

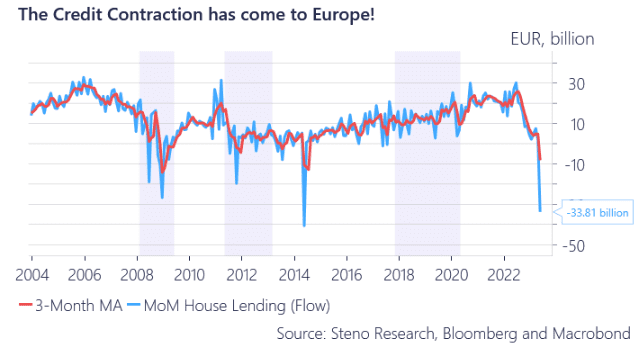

We have spent some time recently looking into the Deposit Guarantee Scheme, and have dug into the details of how it works, what countries that will be most affected by year-end and which countries who are most prepared for the credit contraction, which is finally here if you were to judge it based on monthly developments in house lending, where we are currently at the second lowest level since 2004 – even lower than during the GFC!

Chart 1: The credit contraction is here for good

The deposit guarantee scheme requires all banks to pay a yearly fee to local DGS funds to reach a preset target. But what countries are missing their targets, and who will have the hardest time at year-end?

0 Comments