Equity Watch: Japan – Board or abort Nikkei 225?

Welcome to this chart-dense edition of the Equity Watch, where we zoom in on the Japanese Nikkei 225 and ponder whether it’s too late to capitalize on its stride, or if the bet in fact has got legs and fundamentals working for it.

Yesterday morning CET, the BoJ announced its latest monetary policy decision, and once again, it chose to maintain the status quo. While FX and FI are synonymous to Japan, its equity market has arguably transformed from under-equitized to one of the hottest bull markets in the uncertain conditions of today.

Our findings in brief:

- NISA investment incentives will spur further…

The ‘new capitalism’ overhaul of the NISA system (both general and tsuminate). The general NISA limit has been doubled to 2.4 million yen, and each individual is now allowed to hold a combined total balance of 18 million yen in NISA, which will be tax-exempt permanently. This investment incentive will surely spur further flows into the domestic equity market. Since the turn of the calendar, the Nikkei 225 is up roughly 10%.

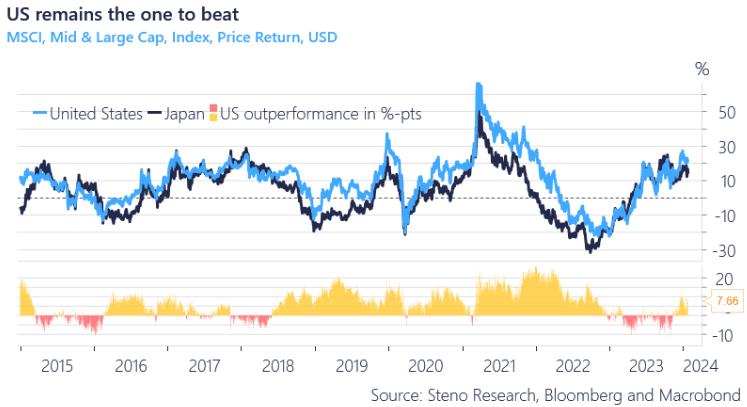

Comparing MSCI Japan to the one to beat, MSCI US, Japan still falls short 7.7%-pts YoY. In terms of participation however, the breadth of the rally is what really sets Japan apart. The median stock within the MSCI Japan is up just north of 30% while the US equivalent is a modest 8%. Top-heavy is fragile, and the Japanese participation is appealing.

Chart 1: MSCI Japan still lagging MSCI US

The Japanese Nikkei 225 has, apart from yesterday’s move lower, been on a streak of strength since the turn of the calendar. So, with its Asian peer on the ropes and the toned down remarks from members of the BoJ regarding inflation, is the index a buy from here?

0 Comments