Equity watch: Fire-sale or Outright Fire in US Bank Stocks

Welcome to yet another account of the still ongoing turmoil in the, by layman discredited, banking sector. Some banks have been faced with reality and rightfully taken a hit, but is the blood-rush warranted for all actors on the playing field? We’ll in this piece have a closer look at some valuation metrics, balance sheets, volatility and credit for US based peers, in order to best answer that exact question – it may be that some are trading at fire-sale-like discounts.

Running a fractional reserve system with thousands and thousands of banks is simply not feasible, if depositor guarantees are to be kept intact

As always we’ll highlight what meets our eye and point to anomalies or actionable trading ideas.

US Banks

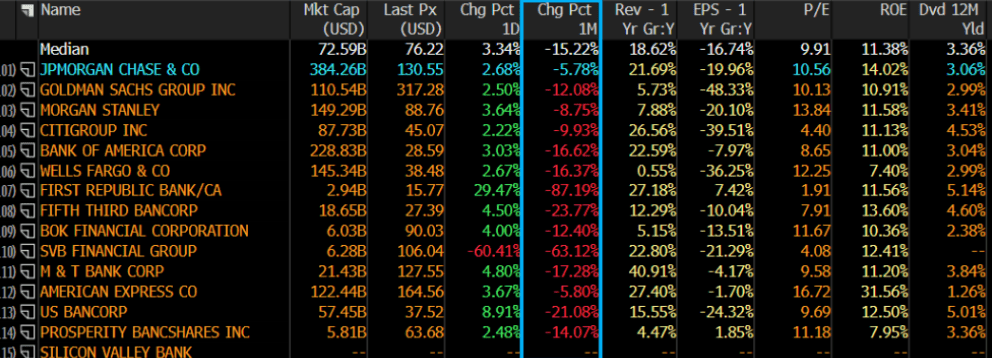

Let’s kick off this investigation by zooming in on the epicenter – the US banks. The market in its entirety has been battered particularly these last days before a relief rally on Friday which extended through Monday and Tuesday. The last month though, the below listed have on average shedded 15.2% of its market cap – that’s some serious capital evaporation. Not all of this can be attributed to patient zero (SVB) or the Swiss debacle leading to the forced marriage between UBS and Credit Suisse but some indeed can.

Chart 1: Overview

What a couple weeks! Confidence in the US banking system has been under immense stress, and some contagion crossed the Atlantic and struck Europe as well. Triggered by a casino in disguise, the troubles have for now been backstopped, but is further distress lurking beneath the surface?

0 Comments