Energy Watch: Red Sea situation is worsening with spill-overs to energy

Welcome to our Energy/EIA watch,

We continue to see extraordinary strong demand for energy in the US, but weaker demand in Europe and China. Meanwhile, the situation worsens in the Red Sea.

Oman begins an investigation into the hijacking of an oil tanker in the Gulf of Oman as Iran’s semi-state agency Tasnim confirmed that Iran was behind the hijacking. Iran getting directly involved in the conflict is an escalation to the proxy-conflict via the Houthis seen over the past weeks.

Both TTF Natural Gas prices and Brent oil have yet to strongly react to this, likely due to almost endless US supply of both LNG and Crude and weaker European demand (See German Energy intensive IP), which is likely to stay weak over the next 6 months. Remember that the German VAT subsidy on electricity falls away this April and the proposed relief plans from the German government are yet to pass through the parliament.

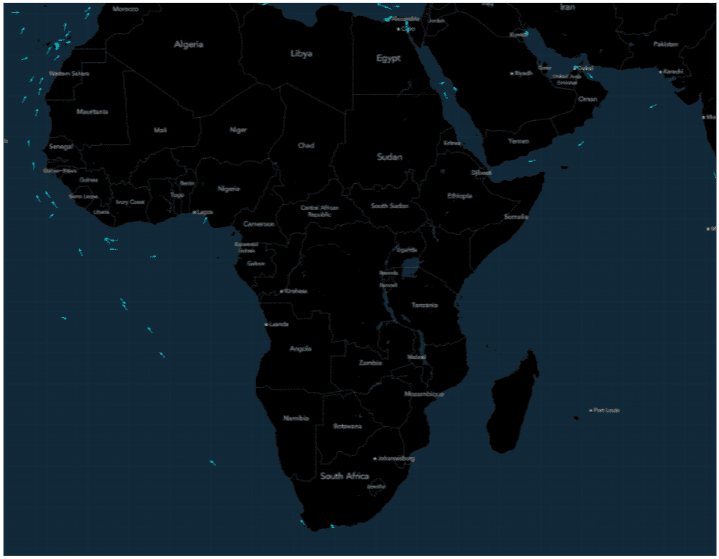

Chart 1: Escalations in and around the Red Sea

Iran is now more directly getting involved in the Red Sea after another week of freight rate increases. We are now seeing spill-overs to parts of the energy space.

0 Comments