Energy Cable: Nowcasts hinting that April was a big false flag

The Shanghai Containerized Freight Index (SCFI) surged 18.8% sequentially to 2,306 for the week ending May 10, marking its fifth consecutive weekly increase. This puts the SCFI at its highest level outside the pandemic boom, as most liners have successfully implemented general rate increases (GRIs) in recent weeks. Spot rates are expected to see further short-term gains, with more GRIs planned for May. This is driven by a combination of worsening port congestion, rerouting of ships from the Red Sea, and increased demand to mitigate cargo delays.

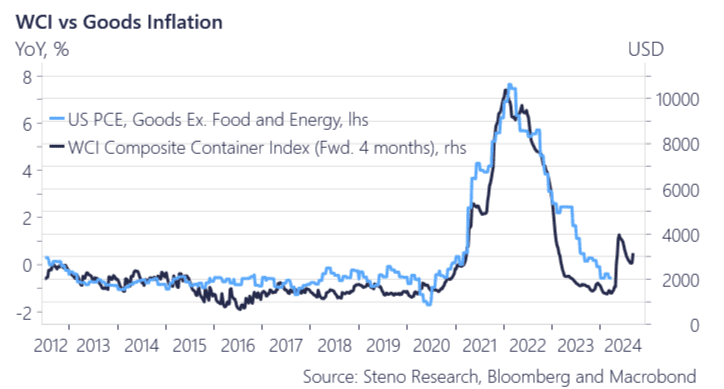

This is potentially huge for the inflationary pressures on goods prices! We wrote a piece on the shipping troubles here.

Chart 1: Freight rates on the move again!

This week we’ll hone in on crude oil with a particular focus on our PCA model for exploring macro movers in different assets. We are long crude again as a reflation bet and looking at the basket sensitivity to crude oil we note the following. Last week’s weakness in U.S. macroeconomic numbers has contributed to easing both the USD and financial conditions, which in turn has benefited crude oil.

The recent US equity performance is, in a historical context, also crude oil bullish due to the US equity markets effect on the USD weakness when it performs. We see strong macro factors contributing to crude strength.

For a potential downside, we see the long end of the yield curve which could throw a wrench in the works given its implications on both global vol, EM/Corporate Credit risks and the USD. All in all Our PCA model still considers oil cheap, which is typically a strong entry point (2 std dev), while our audiology based window model (AI driven technical analysis) also hints that we are close to late innings of the sell-off / correction.

We have accordingly entered the oil bet as well, as it rhymes well with the seasonally strong increase in congestion based data both in the UK, China and in the US. More on that later.

We are seeing improving fundamentals in our nowcasts and see the industrial cycle improving in both China and the US through May again. Was the sell-off in oil temporary in April? We are betting so.

0 Comments