Energy Cable: All the upside left in Henry Hub

Greetings from a rainy and cold Copenhagen. Since we haven’t talked about natural gas for a while we will start out here before turning to crude.

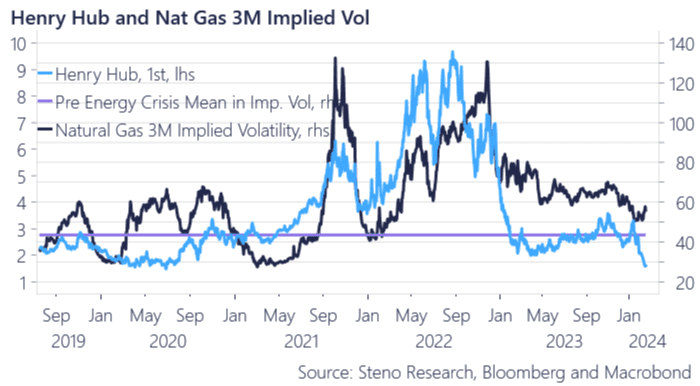

Last week saw Henry Hub making lows last seen during the first wave of Covid in the spring of 2020. The weather in the US has been very benign over the last month after an extreme cold scare in the early parts of January. As contrarians we are very tempted to go long here, since it almost can’t get any worse (famous last words, we know). Speculators are in part kept away from the gas bet due to 3 month implied volatility on an ITM natural gas contract trading above its pre-energy-crisis mean and thus there are no cheap lottery tickets.

We need to see action in the spot market to get prices going. Look out for catalysts for this to happen, but given the storage situation in both Europe and the US it is certainly difficult to envision one.

Chart 1: Back to 2020 lows in Henry Hub

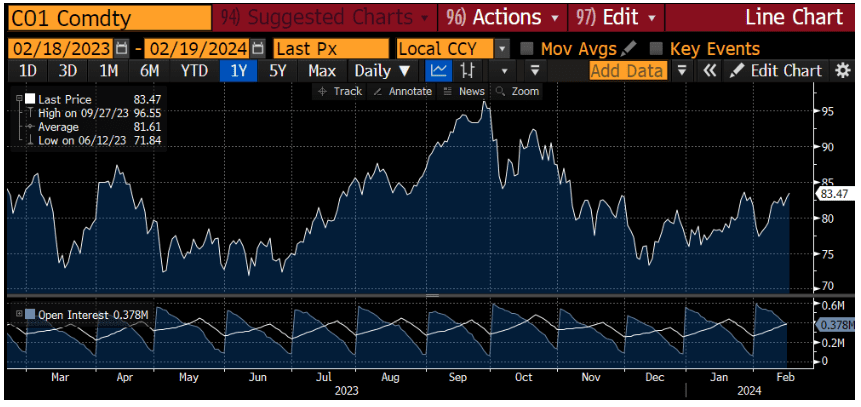

Moving over to crude we are now flirting with Jan highs with positioning moving slowly but steadily in a bullish direction. The 14 day RSI is in the mid 50s and a simple model of price momentum and positioning suggests that we should see the market increasing its longs from here.

Chart 2.a: Testing the Jan highs in crude

Is Nat Gas suddenly the cheapest macro asset on earth? Natural Gas prices are through the floor, which dynamics have improved in the oil space. Let’s have a look at it.

0 Comments