Energy Cable #60: Copper getting some help from China?

Since the beginning of last year when the world had all its chips on the Chinese reopening copper has been range bound between USD 360 and 390. In other words copper has almost been as boring as watching paint dry. It hasn’t gotten much help either up until now.

According to the China Construction Machinery Industry Association, sales of various types of excavators in China witnessed a significant decline in February 2024. Overall, sales dropped by 41.2% year-on-year to 12,608 units. Domestic sales experienced a sharper decline, down by 49.2% from last year, with 5,837 units sold, while exports also decreased by 32% year-on-year to 6,771 units. The latest inflation prints out of China printed positive for the first time since the fall in YoY terms. Maybe a sign of better things to come for the Chinese economy? At least it seems like the Chinese Government is willing to implement some of the necessary measures.

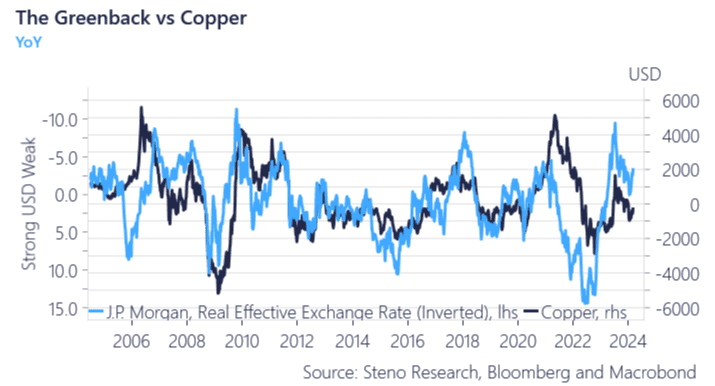

In the US higher for longer has not been a reflation/commodity story where copper would do better. Even though the USD, here measured with JP Morgan’s real broad effective exchange rate, is some 2.5% weaker year-on-year, copper hasn’t really reacted.

Chart 1: We need more USD weakness to get copper going

The Chinese moves toward larger fiscal deficits may be helpful for the energy- and industrial metal cases, but we still lack confirmation from the actual manufacturing cycle globally. Could the commodity complex be the macro case of 2024?

0 Comments