Energy Cable #50: Oil back in fashion

Welcome to this week’s Energy Cable. We finally got stopped out of our crude oil trade at the beginning of last week, only to see crude rally at the end of the week on the back of the FOMC meeting and again today due to the supply chain. We also entered a long in utilities as advertised last week and we are already enjoying a healthy plus, also as a consequence of the FOMC.

Before we get to that let’s start by looking at the latest developments in the German Bundestag. As readers will know we have long been flagging the increase in electricity consumption as a natural consequence of energy subsidies from the German government.

The 2024 fiscal budget, in which the funding for the subsidies is embedded, has now been postponed till next year when it will likely be approved by February. Furthermore, Germany has committed itself to restrict itself to the Debt-Brake rules again by 2024, although Berlin made it clear that they might be forced to suspend the brake again in 2024 due to Ukraine etc.

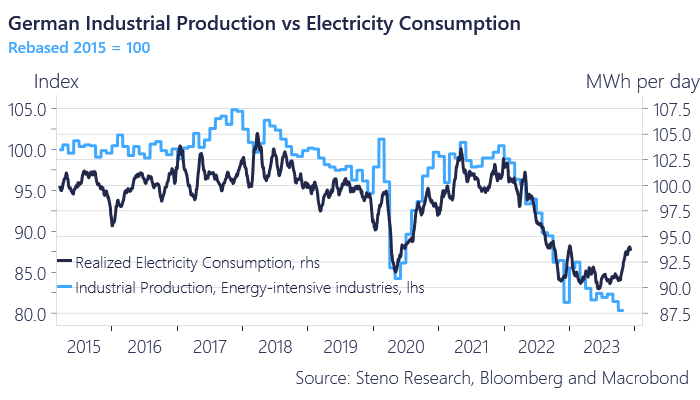

This whole debacle postpones the possibilities of industrial demand really kicking into gear by a few months as well. We note, however, that realized electricity consumption and industrial production from energy-intensive industries are starting to diverge. Unfortunately, we cannot isolate industries and households’ consumption, but if this move is driven by households, then watch out in the European energy space when a subsidy package gets green-lighted. The next IP numbers land in early January and we’ll be keen to see how they come out. The IFO numbers out earlier today made for bearish reading.

Chart 1: Germany starting to consume more electricity. IP to follow now?

Oil is suddenly back in fashion on the back of a dovish FOMC meeting and supply disruptions in the Red Sea. Is the oil bet back on? Or is it too early?

0 Comments