EIA Watch: ALL TIME HIGH Oil demand, but so what?

Welcome to our weekly EIA watch, where we look at the implied energy demand numbers in the US economy and pair them with trends on the supply side.

Price action remains abysmal in US energy markets (if you are bullish that is), and we are admittedly caught wrongfooted here after otherwise strong price action ahead of the OPEC meeting last week.

Conclusions up front:

– Weekly numbers on Oil demand reached an ALL TIME HIGH in week 48

– Nat Gas flows trends were largely reversed towards the end of the month and now look normal

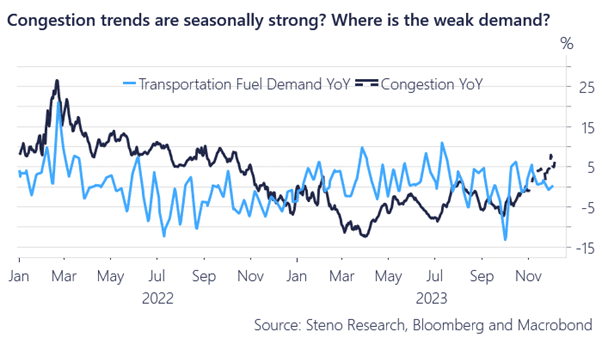

– Congestion is still rising compared to usual seasonal patterns meaning that the transportation fuel demand is strong

– Unless the EIA numbers are 100% out of whack with the reality, the US demand side is NOT behind the weakness in energy space

Let’s have a look at the details.

We track the congestion across harbours, airports and roads and the trend is now up 5-10% versus a year ago. It is hard to see that as a sign of waning demand for transportation fuel, and we are far from EV trends that could explain this difference.

Chart 1: Congestion is UP

The EIA report shows extremely solid demand (as we anticipated for November) but yet price action is not supportive at all in the energy space. What is wrong?

0 Comments