ECB Watch: The ECB is likely wrong on all major parameters

The ECB is currently in motion, taking gradual steps towards a potential interest rate cut. This development signifies a noteworthy acknowledgment of the disinflationary pressures, which have proven to be stronger than initially anticipated by the ECB. Lagarde even acknowledged progress on disinflation compared to the December baseline just over the past few weeks. A rhetorical door wide open to take another dovish step in March.

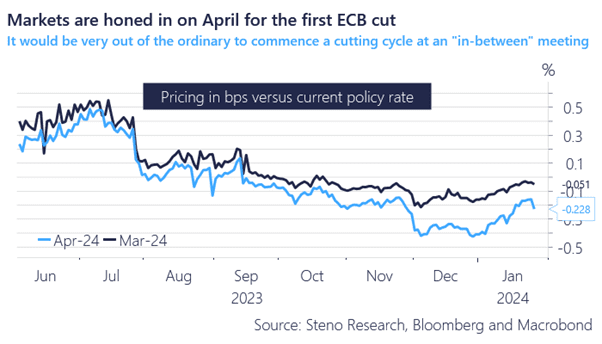

Traders have their sights set on April as the likely timing for the first rate cut by the ECB. The logic is probably that the central bank appears hesitant to make a move before it has further shifted its economic forecasts towards a more dovish outlook in March alongside new projections. But the ECB looks waywardly off on both growth, wages and in particular HICP inflation… Let’s have a look at why.

Chart 1: Markets are honing on an April cut

We see downside risks to the ECBs growth-, wage and inflation forecast for Q1. Is a March cut in play? Or is the market right that they will have to take another dovish step in March before cutting in April?

0 Comments