Earnings Watch: Which Equity markets offer the best opportunities across the Pacific?

The relationship between equity prices and forward earnings expectations is a fundamental aspect of financial markets, and it is influenced by a variety of macroeconomic factors, including economic growth, interest rates, inflation, and investor sentiment. When the economy is growing, so do earnings, and so do equity prices – the relation does, as we’ll uncover, also hold true the other way around, in a contractionary economic environment.

So, where are we? Let’s run the numbers on equities through the lens of earnings.

Global overview

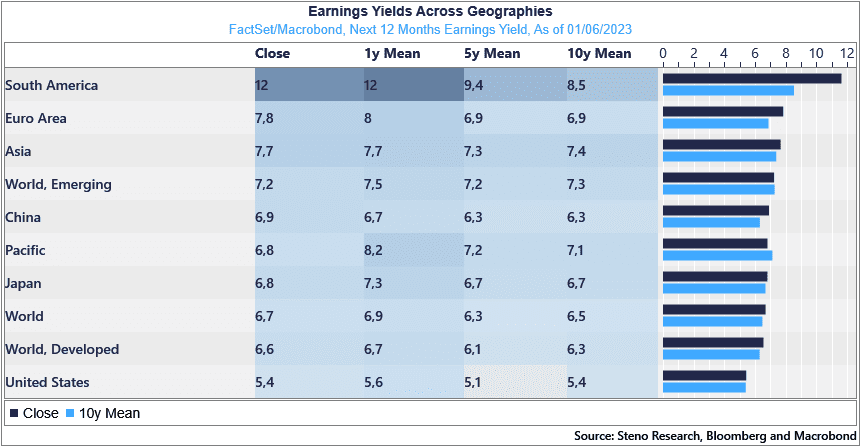

As per historical relation, the table below is distinctly ordered in accordance with the degree of market advancement as well as the amount of foreign direct investments. Leading to these lower valuations, emerging markets are often seen as riskier than developed counterparts due to factors such as political instability, less mature financial markets, currency risks, and less predictable economic growth.

Interestingly, the Euro Area breaks this correlation, and judging by earnings yields, these European broad market equities present lower duration and offer a valuation sub 13x earnings – albeit, that remains 13% above the 10-year average. For reference, US equities are, on a broad-based average, valued at almost 19x earnings, spot on its 10-year average.

On this metric alone, South America looks like a compelling investment opportunity – cheap even from a historical perspective. The continent does struggle with issues of its own though. Argentina for example is currently combating inflation topping 100% YoY. Jeez.

Chart 1: North America is still, by some margin, the most expensive measured on earnings yield

The U.S. and Japanese equity markets present a contrast in earnings expectations, driven by differing economic conditions and monetary policies. Will the optimism for U.S. earnings growth last, and has the immense influx of capital to Japanese markets overbid fair value?

0 Comments