CRE Debt Watch: The initiator or magnifier of financial crises

Historically, commercial real estate firms have posed significant risks to the financial system because of funding vulnerabilities and their impact on the broader economy. Issues in the CRE market have often initiated or magnified financial crises. This is largely because the CRE sector, being debt-financed and closely tied to the financial system, is sensitive to financial cycles.

Commercial real estate stakeholders now face a pressing concern; If post-pandemic behaviors have shifted away from malls and offices, is their investment in physical properties secure?

Experienced property buyers, accustomed to challenges like rising interest rates and economic uncertainties, often wait for rental demand to recover and borrowing costs to decrease. But do they have sufficient time to wait patiently for that to (possibly) pan out?

Our findings in brief:

- Longer duration and…

USA – Best of the worst

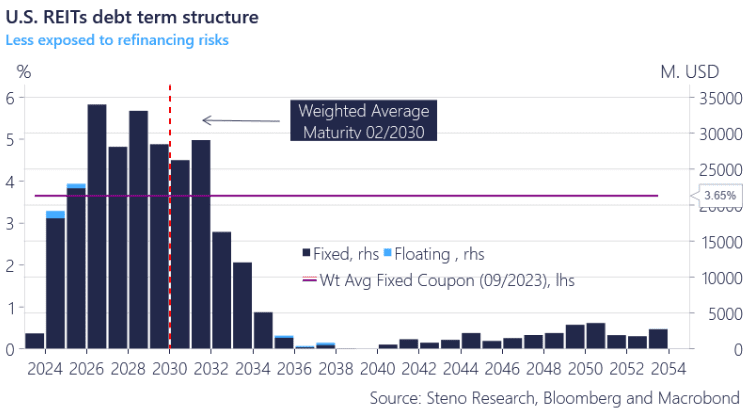

With the extent to which rates are fixed and with a weighted average duration on the entire outstanding commercial mortgage-backed securities (CMBSs) of 6.85 years, U.S. REITs have more leeway to bring down debt and for rates to possibly reprice lower before the bulk of it has to be refinanced – at least relative to cross-atlantic peers.

Chart US.1: Aggregate CMBS term structure

Have markets and REITs come to terms with higher interest rates, and should we really care? We’ve looked to see if a collapse was brewing – in the US or in Europe.

0 Comments