CPI Nugget: Kiss your 2% target goodbye, Powell?

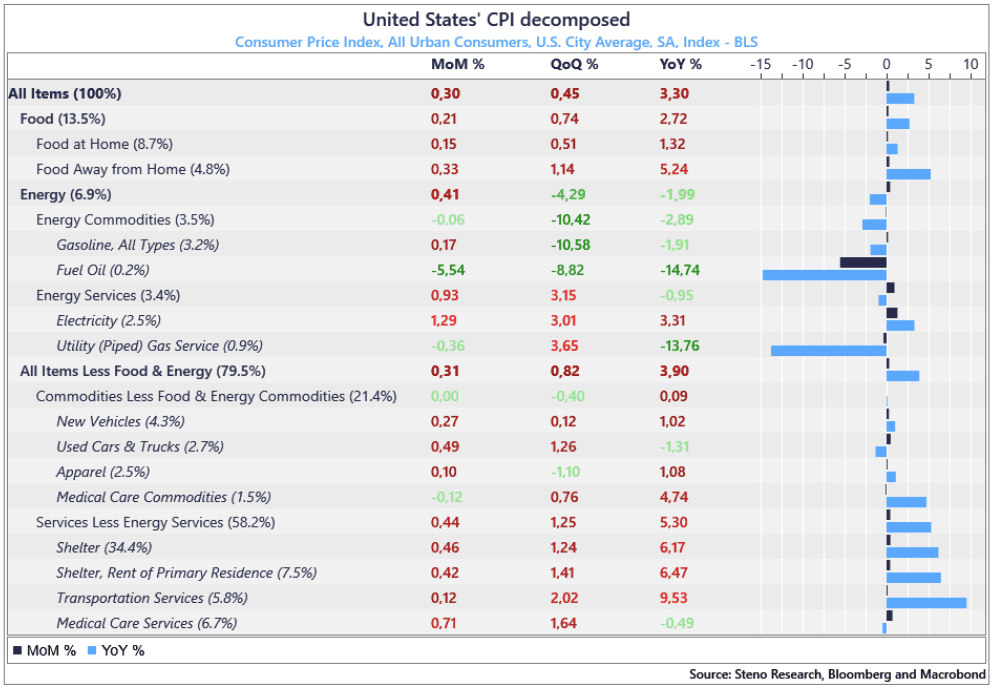

Inflation once again printed smack-dab at our target of 3.9% YoY core inflation and even if there are mixed signals beneath the hood, we are growing increasingly certain that US inflation will not print at 2% or below in this cycle.

The shelter component is probably not waning fast enough for inflation to reach target before a cyclical reacceleration in prices will take goods categories higher again. H2-2024 pricing for the Fed looks oddly off given this.

Take aways:

– US core momentum remains too hot with levels above 0.4% MoM

– The shelter category is too sticky and it will keep inflation above target

– The probability of a re-acceleration in inflation from above target levels is growing

The details of the report reveal that some service categories remain too sticky or too hot to bring inflation back to 2%. The shelter category is simply slowing much less aggressively than forecasted by everyone 12-18 months ago and the recent MoM momentum suggests that annual shelter costs will settle around 4-5%, which is way too hot for a 2% inflation rate target.

Also food- and electricity prices surprised on the upside of expectations, leaving headline inflation hotter than anticipated as well.

Chart 1: CPI decomposition. Shelter proving stickier than expected?

We are growing increasingly convinced that we will not see a single print of 2% or lower in the US CPI in this cycle. Despite a cyclical de-acceleration, the sticky components keep the CPI too high and beneath the hood cyclicality is returning.

0 Comments