Conclusion on Services Week: Our take on equities and the labor market

Welcome back to another piece in our Services Week, where we have a look at what the development in services and manufacturing PMIs might mean for markets, and give you our take on where we are heading, as well as where low-hanging fruits are.

Today we have made our way to equity markets, which in their current state look to have a hard time figuring out in which direction they are heading. The start of a weakening of the labor market had markets rallying, while stronger-than-expected PMIs and unit labor costs pushed the market in the other direction. So what’s going on?

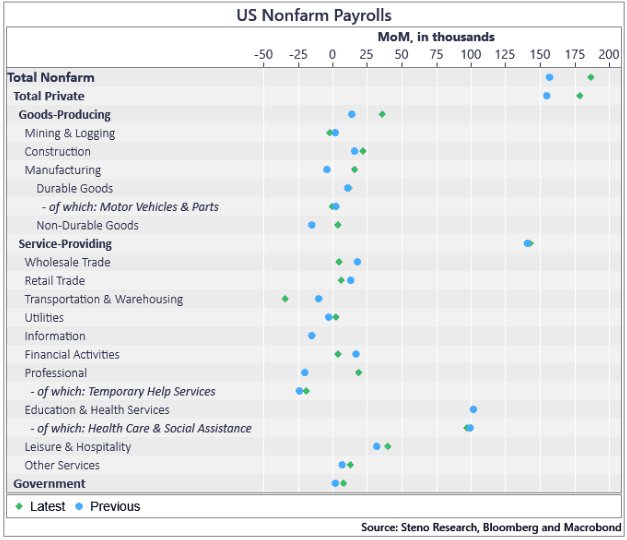

The latest NFP report surprisingly showed stronger than expected growth in the US labor market after weaker than expected job openings data, with growth in both goods-producing and service-providing employment rising compared to last report, and non-durable goods and manufacturing have now moved away from negative territory employment-wise.

The services sector is still primarily held up by healthcare, which remains the stickiest part of the employment basket, while other services-heavy sectors like financials and retail trade have started to slow down hiring. The services sector overall still looks sticky for some time to come (and it looks like markets buy into this story), so if our thesis of a weakening services sector amidst a strengthening manufacturing sector is correct, markets could be wrongfooted big time.

Chart 1: Sticky services sector, while manufacturing rebounds

The first signs of a weakening job market are here, but will there be more to come? And what are the implications for equity markets?

0 Comments