Commodity & Shipping Watch: Time to get back into the shipping bets?

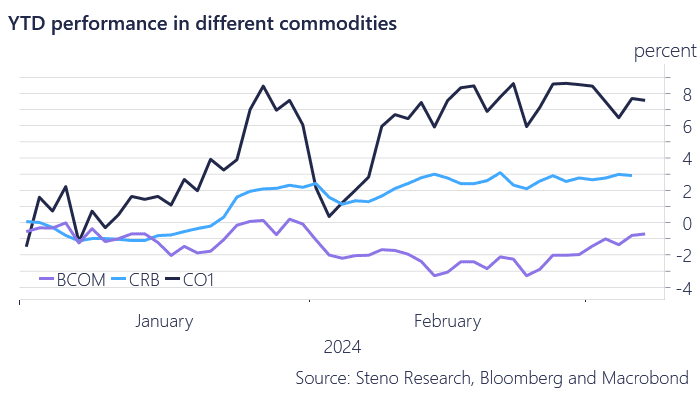

Commodity returns this year can broadly be broken down into 3 categories. Returns in the futures market, in the spot market and in the spot market with backing from a cartel. Rolling futures, as seen in the BCOM index, hasn’t been particularly fruitful due to among other things roll yields.

Managed money has been net short throughout the year and as opposed to crude oil there is no cartel in broad commodities to defend against paper shorts. Spot markets, on the other hand, have enjoyed the increase in inflation expectations, global growth green shots and luxury of avoiding a negative roll yield.

Hence why CRB is up 3% year-to-date as opposed to BCOM being negative. Finally the returns in crude oil show what happens when you combine the commodity spot market with a cartel. OPEC has been very successful in 2024 in terms of keeping paper shorts away from the market but the question still remains how sustainable this squeeze really is? In the medium to long run properly not.

Chart 1: The spot market is where it happens

Shipping stocks have not rallied lately despite the optimism in risk markets. Is a peace deal in Gaza a good sign for shipping companies? And how does it impact commodity markets? The latest Shanghai container output data looks bullish! Find the answers here.

0 Comments