China Watch: The big losers from an imports pull-back

Real estate isn’t the only sector in commotion. Chinese imports have plummeted and this too has implications for global markets. Without further ado, let’s dive into some statistics – welcome!

The CNY is still in the driver’s seat of cross-market action. The PBoC has actively sent firm signals with fixings just above the 7.20 handle and it is safe to say that they are trying to deliver the memo to CNY bears. You shall not pass 7.30!

Despite briefly above, the rhetoric seems to have worked and the USDCNY-cross is at the time of writing trading at 7.2921. Might seem counterintuitive as the PBoC delivered a 10-bps cut on the 1-year-LPR (now 3.45%) yesterday amid broader concerns of the rapidly depreciating Yuan, but their on- and offshore selling of USDs seems to have countered the cuts.

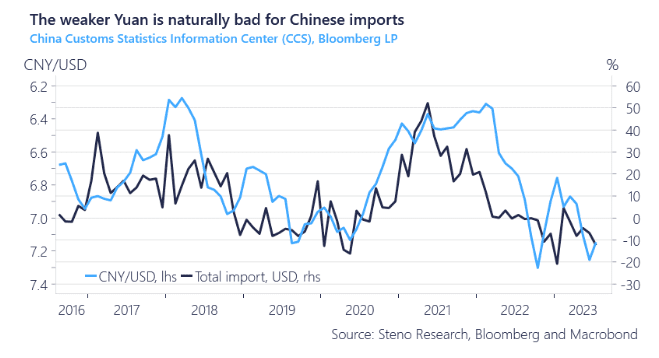

The weak Yuan translates to relatively more expensive USD-settled imports, which may be positive for inflation targets but not so much for most global financial markets and some exposed trade partners in particular.

‘When China sneezes the West catches a cold’. We’ve said that before, but who is really most reliant on a well-functioning Chinese economy? Europe is now clearly the next shoe to drop. Could long cyclical Asia vs short Cyclical Europe be a strong RV trade?

0 Comments