China Watch – Foreign Direct Investment & Capital Controls

Welcome back to another piece on the ongoing turmoil in China, which seems to have slipped headlines over the last weeks as USDCNY has stabilized around the 7.30 level, which seems to be the line in the sand for now.

Xi and PBoC currently stand in a big dilemma, as a weaker exchange rate incentivizes domestic capital flights from CNY to USD amidst a domestic consumption crisis and real estate hovering at recessionary levels.

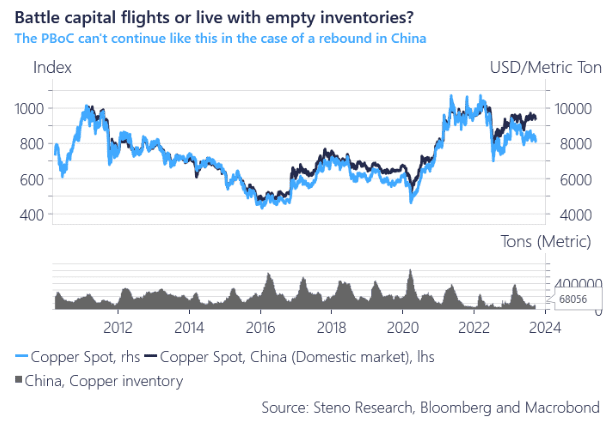

To cope with capital flights, PBoC controls imports and exports of various commodities on the domestic market, forcing domestic banks and other players to keep their trading activity in CNY by strengthening the Yuan. The restrictions on imports (and almost complete ban on exports from the domestic market) however increase the price on the domestic market, of course making it attractive for sellers to stay in China, but the buy side weakens as the premium on the domestic market relative to world prices increases.

While such a solution works for defending their currency (China’s Gold Exchange is one of the biggest globally), it creates the risk of 1) a dysfunctional market and/or 2) a situation where almost empty commodity inventories (like copper) stay low due to restrictive imports, holding back the possibility of an industrial rebound, paired with domestically higher prices, lowering the change of such rebound even more.

Chart 1: Copper inventories not ready for a rebound

Despite communicating to cure the CNY to prevent capital flights, the PBoC is likely going to allow the exchange rate to float even higher than now to boost foreign investments, which is the only medicine that can cure the Chinese economic disease.

0 Comments