China Deflation Watch – What happens in China stays in China

Hello everyone, and welcome to our China Week where we try to gather all forces to cover the ongoing economic situation in China, which is subject to substantial volatility and political turbulence currently.

In this piece, we will look at Chinese deflationary trends and whether they will spread to the West and/or elsewhere on the globe.

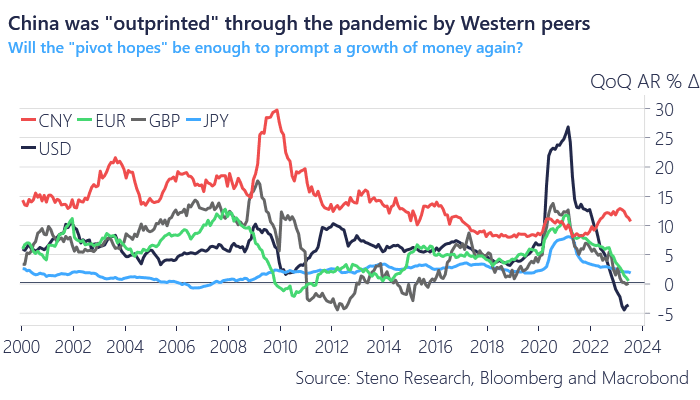

Through the Pandemic, China was “outprinted” / “outcredited” by the US, Europe and the UK for the first time in several decades. After year after year as the global credit engine, China is no longer firing on all credit cylinders.

Conclusions up front:

1) Chinese credit growth is clearly not as it has been and the deflationary impulses stem from a lack of credit/money growth

2) China’s role as the manufacturing hub of the West is diminishing and the impact of deflation on goods is smaller than it has been historically in Europe and the US. Chinese prices will accordingly impact Japan more than the US

3) There are early signs of a rebound in Chinese prices, which is not a pleasant directional harbinger for especially USD prices (and ultimately also EUR prices) and China can impact the global inflation cycle via commodities

4) Chinese growth held up by domestic consumption so far, while capital formation and net exports suffer

Chart 1: China is no longer the credit dove of the world

Things are starting to look worse for China just as everyone started to sense that a rebound might have been on the menu. Real estate is turning outright bearish as we speak, but will China continue to be the West’s manufacturing hub?

0 Comments