Business Cycle Watch: Why Sweden’s Resurging Momentum is a Must Watch

In this brief update on the business cycle, we will present a comprehensive overview of the current economic situation in Sweden. The Riksbank initiated its first rate cut in May, and we anticipate additional cuts throughout the autumn. This makes Sweden an ideal “live-studio” for observing the effects of early rate cuts on the economic cycle.

Here is a summary of our findings:

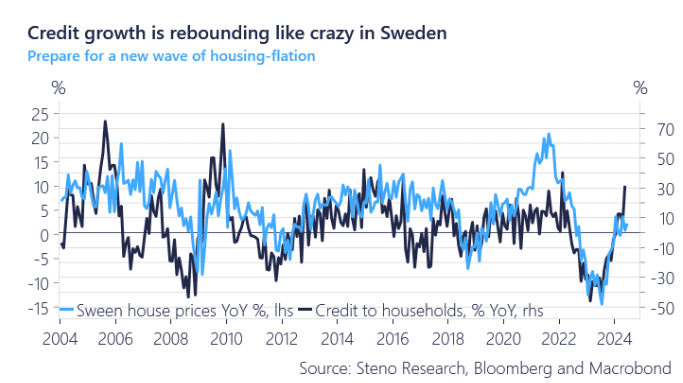

Credit Cycle: The credit cycle in Sweden is improving rapidly, with an increase in credit for house purchases. This trend is expected to lead to higher house prices and rents.

Employment Cycle: The employment cycle is lagging behind the production cycle. However, we are observing significant positive developments in Sweden’s profit cycle, indicating potential growth in employment.

Orders to Inventory Ratio: The orders to inventory ratio for Swedish industrials suggests a substantial re-acceleration in the second derivative of cyclical prices, pointing to an upcoming increase in production activity.

Bankruptcy Cycle: The bankruptcy cycle has clearly passed its peak, with underlying credit solidity improving. Sectoral analysis shows a decline in bankruptcies in the struggling property sector and in manufacturing/industrials. These sectors typically lead the way out of a downturn and into a cyclical upturn.

With short-term forward rates in Sweden projected to bottom out around 2% in a few years (compared to the current spot policy rate of 3.75%), we believe that the pricing for 2025 is increasingly misaligned with the current cycle development and see a decent tactical upside in e.g. 2-3 yr SEK rates.

Chart 1: Credit growth is BACK

Chart 2: Cyclical prices will likely regain momentum in Sweden soon

With the first rate cut now in effect, the Swedish economy has suddenly become an interesting “lab” for observing cyclical growth and inflation trends. All indicators point to a re-acceleration in Sweden, which the rest of the world will likely follow.

0 Comments