5 Things We Watch: The BTFP, US and EU Deposit Flights, Credit Tightening, and The FFR

Welcome to this week’s edition of the weekly recurring ‘5 Things We Watch’-series.

The ongoing deposit flight remains what captivates our focus. What are the ramifications of an ongoing deposit flight, are the European counterparts really better off than its American peers, and has the trigger event for the much ‘awaited’ recession occurred? We’ll in this article address that and much more.

This week we’ll try to uncover the following 5 pressing questions captivating macro:

- Liquidity – and that of the BTFP facility

- Continued deposit flights in the US

- European flights and why it’s less pronounced

- Further credit tightening to seal the coming recession

- Fed Funds rate has peaked

Without further ado, let’s dive right in.

Added liquidity from the BTFP

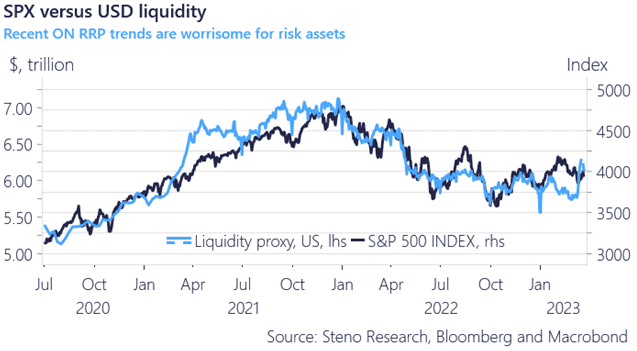

While the crisis is still ongoing and the Fed is beginning to cave in, liquidity is improving beneath the surface. In recent weeks, short-term lending from the Fed has increased net liquidity, even if it is on the back of a stress scenario.

Net liquidity current hints of a >4000 index fair value for S&P 500 and the deposit flight will now mechanically NOT lead to a drop in liquidity as the Fed allows an increase in liquidity to match the outflows. That doesn’t rule out a sharp sell-off, but if equities turn very cheap relative to net liquidity, you know it is time to place your wealth in high beta index-funds and enjoy the ride in coming quarters/years.

The recent turbulence in the banking system has been for the history books. It may have cost the lives of some banks on both sides of the pond, but has the situation finally dialed down? We turn to our timeliest gauges on the deposit flight crisis and weigh up how to position for it.

0 Comments