The Week at A Glance: Everything you need to know ahead of the FOMC and CPI

Welcome to our concise weekly overview of key events, expectations, and positioning strategies. This week, we focus on the Federal Reserve meeting, US inflation data, and the crucial Bank of Japan meeting.

Event 1: NFIB Survey (Tues) – signs of a re-acceleration in growth? Goldilocks vibes?

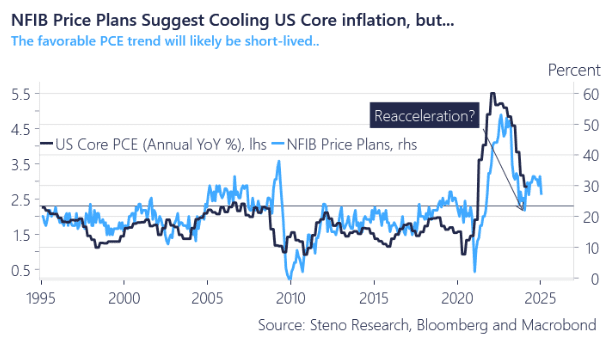

As usual, the most crucial forward-looking inflation evidence is found in the NFIB report released ahead of the CPI report.

We already have some details from the report. For instance, hiring plans have shown a rebound in May after a prolonged period of weakness. Notably, the survey typically aligns with initial claims, which has not been the case in this cycle. This discrepancy suggests that hiring plans might exaggerate the current weakness in the US labor market, as net hiring has recently shifted towards very small employers (1-9 employees), mostly outside of the NFIB scope.

Additionally, we’ve observed a positive trend in actual sales volumes reported by NFIB respondents, indicating that the worst may be behind us. The lending-based survey has stabilized at levels corresponding to continued positive credit growth.

The most important aspect of the NFIB survey is the price plans, which typically lead Core PCE by about six months. The NFIB survey was an early indicator of the re-acceleration seen earlier this year and continues to suggest a plateau around 3% core PCE inflation or a minor re-acceleration, at least until late this year.

We don’t expect the NFIB report to significantly impact markets (as it rarely does), but it will help guide our macro trajectory in the portfolio in the coming months. For now, it points to 1) improving underlying business trends in sales, 2) accelerating price plans and 3) no imminent risks of a credit contraction.

Chart 1: Downtick in NFIB Price Plans last time, but will freight rates have its impact?

The Fed will have to deal with a backdrop that is more hawkish than anticipated on most major parameters. Will they dare to continue highlighting a couple of cuts this year?

0 Comments