The Great Game – Geopolitical Overview Q2 2023

An Overview

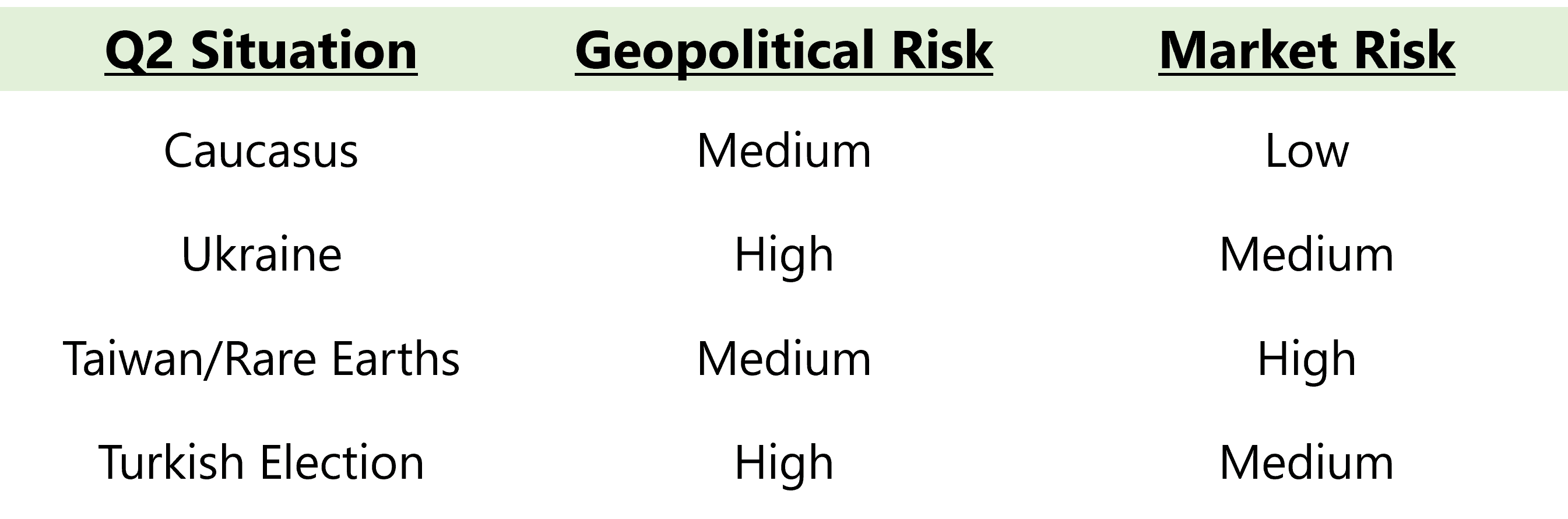

These are the four Q2 situations we will be covering today. If a situation has less than “medium” geopolitical risk but a “high” market risk, we don’t spend time on that – but rest assured that the rest of our team at Steno Research will!

Let’s dive into them one by one!

Caucasus

Since Azerbaijans stunning 2020 victory over the Armenian forces, an uneasy ceasefire has existed in the Nagorno-Karabakh Region. We have seen reports of regular skirmishes and as soon as this Tuesday, new emerged. Hundreds of soldiers have lost their lives in border clashes since the 2020 war, and things are heating up again. But why is this local conflict relevant? First of all, it’s more of a proxy war, really. Historically, Armenia had the backing of Russia and was therefore out of reach for the Azeris. But in recent years, Turkey ramped up their support of Azerbaijan and this enabled them to gain the upper hand in 2020. Shockingly, Russia did very little to help Armenia and forced Yerevan to make significant concessions in November 2020. Since then, Russia has become engulfed in the Ukraine debacle and has little time or resources to police the Caucasus. In steps Iran with token support for Armenia due to their concerns over a growing Azeri secessionist movement in Northern Iran. So even if the conflict seems quite contained, it has regional and global impacts.

Geopolitical Risk: Medium

A potential rift between Turkey and Iran is very significant in geopolitical terms. We expect tensions to continue in the region – especially up until the Turkish election. What’s more, an Azeri escalation and renewed offensive would put the spotlight on Russia’s inability to police its former sphere of influence. This leaves an interesting question – who will administer the Caucasus in the future? Turkey, Iran or perhaps China?

However, the failure of the Iranian revolution has shut the window for Azerbaijan to instigate increased troubles in the ‘South Azerbaijan’ region, so further events in that region is unlikely.

Market Risk: Low

Even though Azerbaijan is a major oil supplier, the conflict is almost entirely landlocked and has little bearing on global trading routes or supply lines. We expect little direct influence on global markets as a result of possible renewed conflict in the Caucasus.

Ukraine

We cover Ukraine on a regular basis, so regular readers will know all they need to about this conflict. The Russians have stalled and the Ukrainians are planning a spring offensive and even went as far as to post a tease for it on Twitter! So basically, the The question is all about manpower now. Many analysts are suggesting that Russians must be running low, but so might the Ukrainians be. In any case, the Russians have squandered their strategic initiative and huge amounts of men and material on very little headway.

When the Ukrainian counteroffensive hits, they will undoubtedly make gains and raise cheers in the West. But for how long can they sustain the offensive? If the Russians have the men, they will be very hard to break down or force out of Ukraine entirely. And if the Ukrainians manage to strike deep towards the Black Sea or threatens the major cities of Donetsk or Luhansk, the investor will have to keep a very keen eye on the Russian response. We’re not talking nuclear weapons – but the Russians still have a lot of economical and financial weapons they can bring to bear.

Geopolitical Risk: High

Obviously, the geopolitical risk is enormous in the Russo-Ukrainian War. It’s the defining conflict for the Western and Russian worlds for this century and the US and Chinese are both heavily involved.

Market Risk: Medium

The initial economical and financial effect of the Russian invasion was enormous, but since then, the markets have been paying less and less attention to the war. This is logical, because the frontline of trade and sanctions have reached a stalemate much like the physical frontline in the Donbass. No-one is talking about further sanctions and both grain, gas and oil are finding its ways out of Russia onto the world markets.

The thing to watch for the investor is the Russian response to Ukrainian spring gains. If Putin is unable to respond militarily, could he get the Chinese and Saudis to raise the price of oil even further? Could he force India and Turkey to freeze second-hand deliveries of Russian energy and goods to Europe? Could he get the Chinese to impose sanctions on the EU and the US?

Taiwan and Rare Earths

The Easter period saw the Chinese engage in almost unprecented naval maneuvers and drills around Taiwan. We have covered the conflict intensively in this space, but let’s look a little wider at the entire US-China rivalry. This week saw two major news – the Chinese are now considering a ban on rare earths exports to the West, and at the same time Tesla announced the construction of a battery mega-factory in Shanghai. This is only the latest move in the global race to secure rare earths and the supply lines they support. The Chinese have a major advantage in this game and while almost all other big tech companies are moving out of China, Tesla is now moving in. It’s hard not to see the connection. Tesla is afraid that they will simply not have the required supply flow to build car batteries outside of China. That should be a mindblowing realization to both European and American politicians and this should be major talking point throughout Q2 and the coming quarters. How is this connected to Taiwan – well, the US-China rivalry is only going to increase, and Taiwan is the ‘voodoo doll’ of this conflict. China and the US can hurt each other by proxy without engaging directly and thus Taiwan will continue to be used to send messages across the Pacific. This also means that you shouldn’t be too worried about a Chinese invasion of Taiwan – but see the Taiwan brinkmanship as a measuring stick of the US-Chinese animosity.

Geopolitical Risk: Medium

How on earth can the risk be only ‘medium’? Well, as described, I see no risk of an actual conflict over or on Taiwan. A Chinese now clearly holds a naval blockade in their toolbox, but there is little reason to execute such a move right now. So to sum it up – China will not invade Taiwan and Taiwan will not declare full independence.

Market Risk: High

The game over rare earths and ‘green commodities’ could not be of higher economical and financial significance. We have only seen the first moves on the chess board and it hasn’t dawned on Western politicians that this game is even going on. I think Q2 will be a major eye-opener for the Western world, which could certainly effect markets. Watch out for future editions of our Commodity Watch series!

Turkish Election

In a very poor 2023 election-wise, we at least have the showdown between Erdogan and Kilicdaroglu to look forward to! We set the stage in an extensive piece here, but let’s just sum it up. Reigning Prime Minister Erdogan is facing a tough election against the opposition leader Kilicdaroglu, who is widely seen as more moderate and secular than Erdogan. The past year has seen huge economic troubles and a major earthquake that pointed to mismanagement within the Erdogan administration. However, Erdogan has done well on the international stage, both securing a very symbolic triumphs for the Turkic brothers in Azerbaijan, but also shoring up Turkish influence on the global stage as well as a de facto mastery of the Black Sea. Erdogan has placed Turkey on the world map, but will that matter to the inflation-plagued voters?

Geopolitical Risk: High

Immediately, the Turkish election will likely decide if or when Sweden can join NATO. That’s a very direct geopolitical effect on an election, but Kilicdaroglu is also expected to alter the course of Turkey in other areas. He has pledged to “re-democratize Turkey” and solve the Kurdish question in a “democratic manner”. This would be of major geopolitical significance, although Kilicdaroglu is unlikely to alter the Turkish course vis-a-vis Russia or China. This will also depend on the backing majority he might have to base his government on. Furthermore, we can’t rule out internal instability in the wake of the election. We all remember the foiled coup against Erdogan and it’s unlikely that his followers will react well to a possible election defeat.

Market Risk: Medium

Turkey is an increasingly important player on the global financial stage and with the economy being the absolute #1 topic, we don’t expect the candidates to hold back on lavish guarantees to the electorate. We have even seen some parties engage in extreme economical nationalism and they could very well end up influencing the government program if they are to support either candidate. However, the major reason for watching the Turkish election as an investor is the risk of instability. Anything less than a smooth transition of power would only add to the chaos of the region and the global economy.

That sums up our Q2 Geopolitical Overview. We would really like your comments and thoughts on topics that we missed or where we are dead wrong!

0 Comments