Steno Signals #97 – 5 reasons why the CNY will be devalued next week and how to trade it

Happy Sunday from a sunny Copenhagen.

I spent last week in Asia and even though I admittedly like to see my research as edgy and contrarian, I quickly realized that most PMs in the region agreed on my take on the imminent risk of a devaluation of the CNY.

USD/CNH call options are popular/consensus in the Asian Macro PM space, but interestingly there is no consensus around the contagion from a devaluation of the USDCNY. The discussions I had pointed in all directions, meaning that a CNY devaluation holds the potential to turn into a macro earthquake, despite it already being a consensus position.

In this weekly editorial, we will look at five reasons why Chinese FX policy action is IMMINENT, why USDCNY will likely have to move a lot higher and ultimately provide our read on how cross-asset markets will react to such an event.

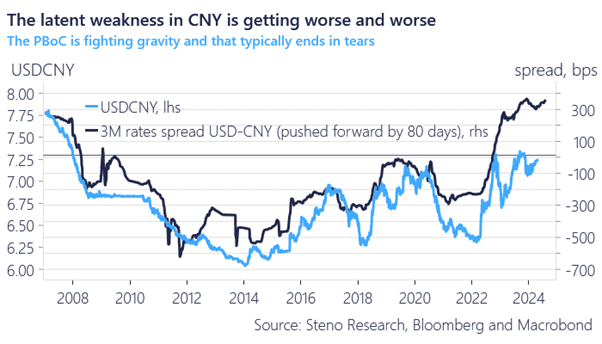

The latent weakness in CNY is getting worse and worse and the underlying selling pressures will remain intact until the PBoC allows USDCNY to trade in the 7.75 – 8.00 range against the USD.

Let’s have a look at the details of what may prove to be the biggest macro event of 2024 (so far).

Chart 1: 7.75-8.00 next up in USDCNY?

The list of triggers for a material devaluation of the CNY keeps getting longer and action is probably imminent. The question is how markets will react to such an event and whether it will prove to be a new trend.

0 Comments