Steno Signals #67 – 150bps higher 10yr yields and parity up next in EURUSD?

Happy Sunday from Rome, Italy and welcome to our flagship editorial.

By the time of writing, I am sitting at my hotel having breakfast ahead of the final day of action at the Ryder Cup. There are good reasons to chant “Europe, Europe, Europe” on the golf course, but not in financial markets as Europe is once again tested by commodity developments.

Oil markets remain in the driver’s seat of everything in Global Macro and even if it already feels like this energy squeeze is old hat, we find a continued strong risk/reward in betting on higher energy prices.

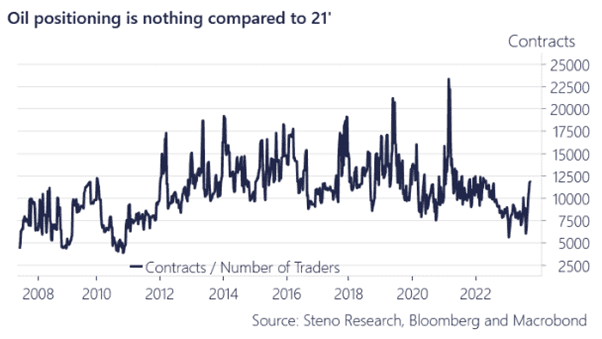

Our “chart of the week” reveals that the paper-market volume behind this latest oil market rally is very low, leaving the fear of a stretched positioning relatively dampened, which will allow the undersupplied physical market to drive price action. US production has increased and is now close to max capacity utilization, leaving Bin Salman / Putin in charge of supply news from here.

Conclusions up front:

– The oil market party is not over unless we misread the very light volumes in positioning

– Natural Gas markets are likely to turn physically very tight through October/November, leaving risk/reward solid of betting on the upside

– The pain trade in FX remains long EUR and JPY due to the vulnerabilities in energy balances

– Everyone and their mother is long duration risk amidst this. We understand why, but we want to see blood on the streets in fixed income first before daring to enter.

– Only companies with strong pricing power will hold up through this environment in equity space

Chart of the week: Oil positioning is nothing compared to 2021/2022

We know the playbook from last year if the energy squeeze is just getting started. Rising demand/activity in the energy-intensive industry is a negative for the overall asset market in regions with scarce supply. Parity up next?

0 Comments