Steno Signals #59 – When it rains on Janet Yellen, it pours!

“Money grows on the tree of persistence.” – Japanese Proverb

Happy Sunday and welcome to our flagship editorial!

Either you do Japan, or Japan will do you! We have been covering Japan extensively throughout the year and it saved us from being run over by a steepener-bus in markets over the past week.

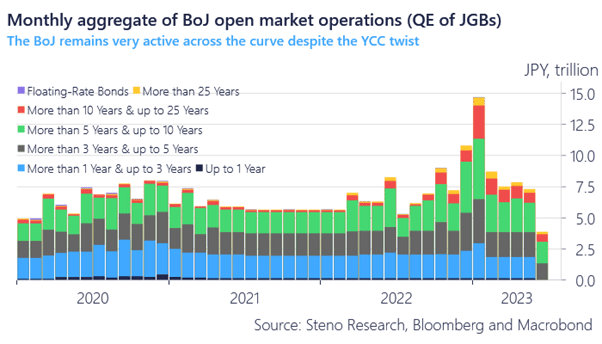

The Bank of Japan is still active in the JGB markets after having moved the needle on the YCC-cap, but they are much less interventionist than just 3 months ago. Japanese 2yr yields are now trading above 0% and the BoJ has not really been active in the 1-3yr space lately

This could be a signal that Governor Ueda now plans on guiding markets instead of buying them to keep volatility low.

The endgame is currently very clear. The BoJ will slowly but surely leave more room in JGBs for local L&Ps, and they will hence disappear to a larger degree from US Treasury and EUR sovereign markets.

Real money institutions have been buying bonds in size over the course of Q1 and Q2 in anticipation of lower rates, but there is not really any light at the end of the tunnel on that trade right now.

Chart 1: The BoJ is moving from an interventionist to a less interventionist approach

The Bank of Japan has fueled a global curve steepening and the US Treasury is forced to emphasize the trend with substantial ramifications for liquidity, rates, FX and equities. Here is how we play it!

0 Comments