Steno Signals #40 – The banking crisis is likely to accelerate in coming weeks

Welcome to our weekly flagship editorial. We will try to be as a concrete and actionable as possible today amidst one of the trickier environments lately. It is all known stuff since this is an environment we have seen before when yield curves have inverted. Our base-case is that the crisis will turn much worse in coming weeks before central banks finally admit to the issue being of monetary nature ultimately.

Banks have a hard time dealing with an extraordinarily inverted yield curve due to 1) the risk of a deposit flight and 2) mark-to-market losses on bond portfolios. We can continue to explain these cases away as stand-alone cases, but the underlying reasons are found in monetary policy, and this is about as strong a hint that you get that the hiking cycle is over.

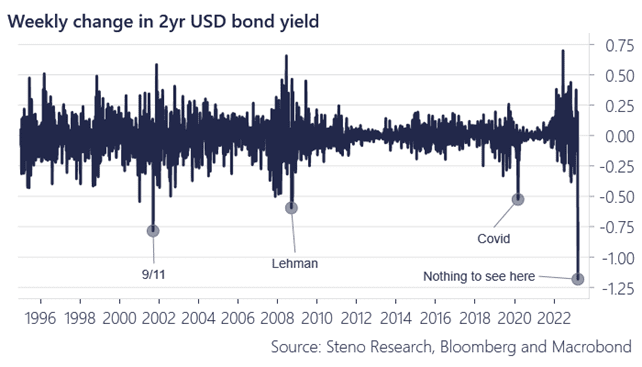

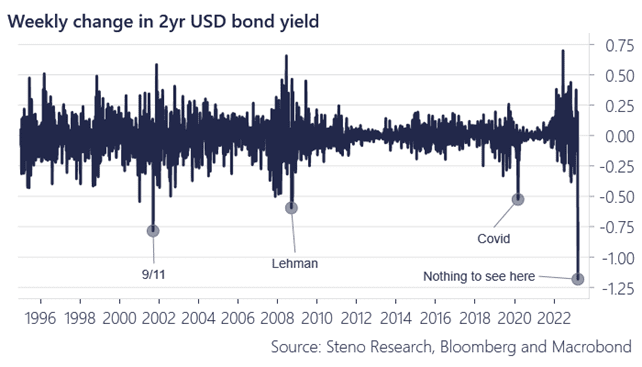

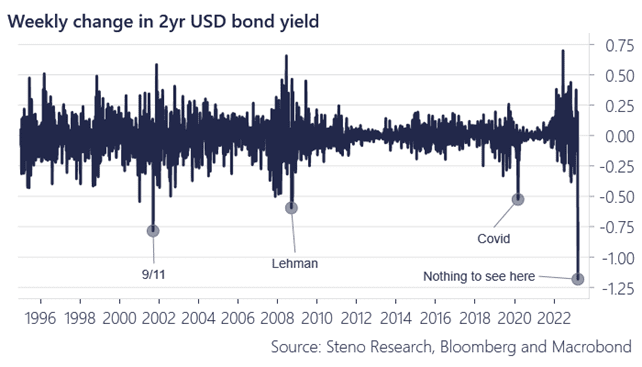

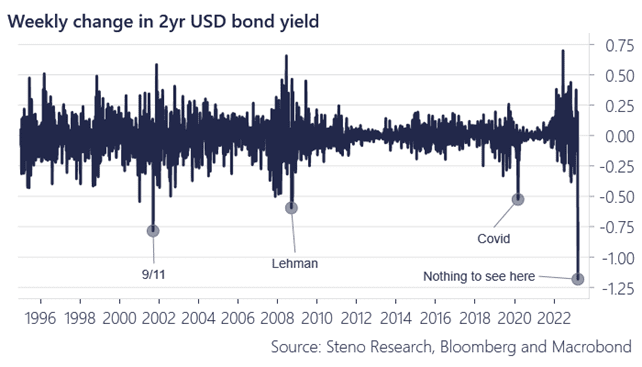

The below chart is a good example of how loud the bond market screams now. Either the Fed emergency cuts within 1-2 months or else this turns into an outright crisis.

This is of relevance to your portfolio composition across ALL assets and we have flipped quite a few views/positions over the past week as a consequence of what is unfolding! You better care about it now, before the central banks understand the issue.

We will elaborate on our crisis-portfolio below. Try us out with a FREE 14 day trial!

Chart 1. Nothing to see here

Welcome to our weekly flagship editorial. We will try to be as a concrete and actionable as possible today amidst one of the trickier environments lately. It is all known stuff since this is an environment we have seen before when yield curves have inverted. Our base-case is that the crisis will turn much worse in coming weeks before central banks finally admit to the issue being of monetary nature ultimately.

Banks have a hard time dealing with an extraordinarily inverted yield curve due to 1) the risk of a deposit flight and 2) mark-to-market losses on bond portfolios. We can continue to explain these cases away as stand-alone cases, but the underlying reasons are found in monetary policy, and this is about as strong a hint that you get that the hiking cycle is over.

The below chart is a good example of how loud the bond market screams now. Either the Fed emergency cuts within 1-2 months or else this turns into an outright crisis.

This is of relevance to your portfolio composition across ALL assets and we have flipped quite a few views/positions over the past week as a consequence of what is unfolding! You better care about it now, before the central banks understand the issue.

We will elaborate on our crisis-portfolio below.

Chart 1. Nothing to see here

What is the underlying issue?

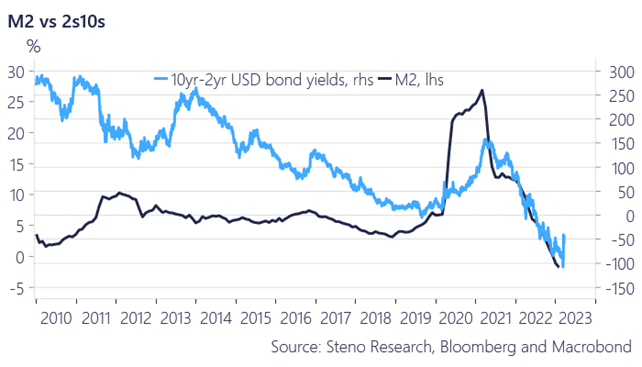

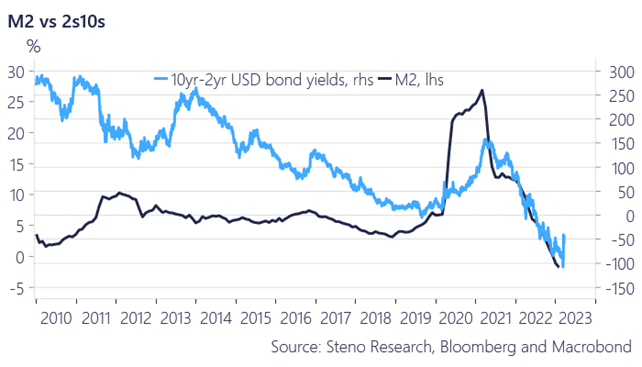

So why is this crisis underlyingly driven by monetary policy? After a wave of fiscal spending that Dan Bilzerian could not have orchestrated better in 2020-2022, the medicine has been to destroy money to bring inflation down. Outright negative growth in the money supply happens only very rarely in newer financial history and it is one of the strongest signals that a turbo-inverted yield-curve is on the cards. Destroying money/credit is the safest way to kill an economic cycle, which is what an inverted yield-curve ultimately hints of.

We warned of a historic curve inversion already a while ago and traded the yield-curve flatteners accordingly through Q4/Q1 but have now flipped completely.

We find that the curve will have to re-steepen very fast from here as the Fed and the ECB pulls the plug on their hiking plans.

Chart 2. Money growth dictates the yield curve

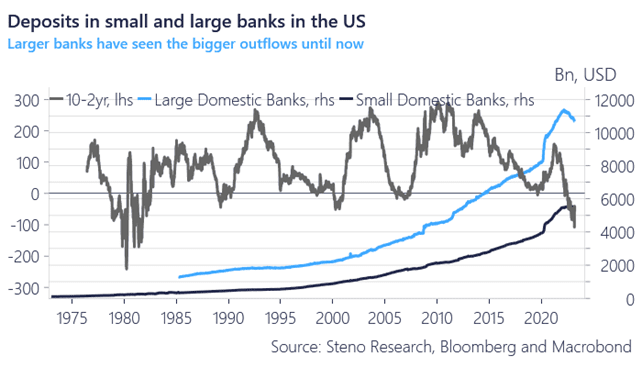

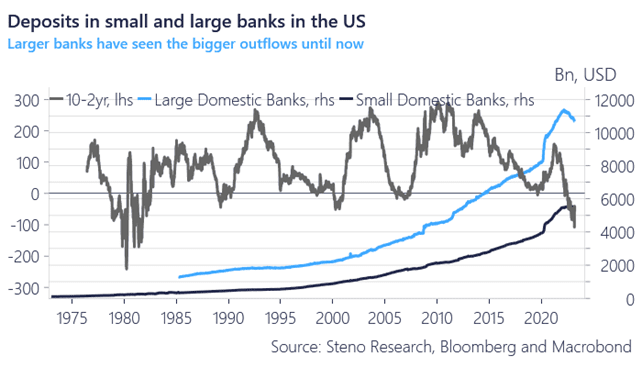

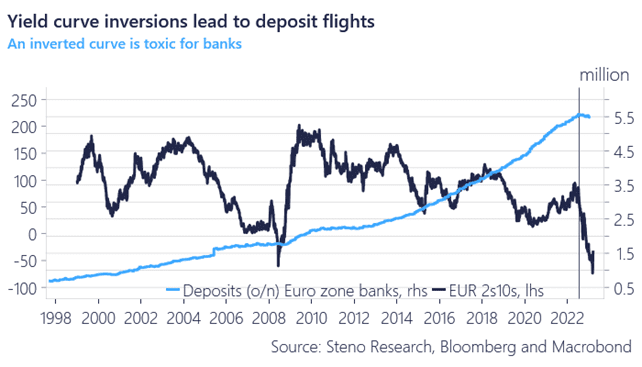

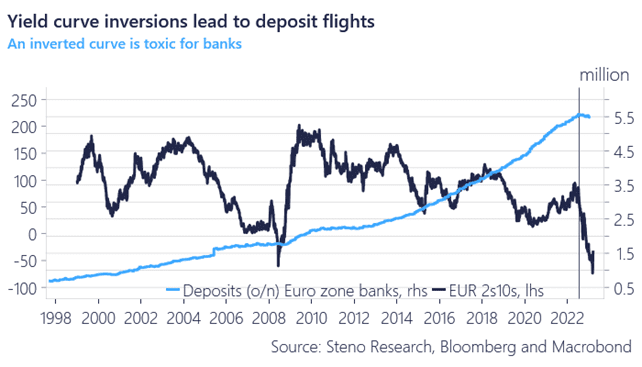

Banks are vulnerable to large inversions of yield curves. A bank funds itself shorter on the curve than it’s asset base, which allows them to ride the positive carry of an upwards sloping yield curve.

When the yield curve turbo-inverts, banks typically try to create their own yield curves by not allowing deposit rates to follow policy rates higher.

Chart 3. When the curve inverts, banks slowly but surely start losing deposits

This is exactly what has happened in recent quarters as banks have NOT raised deposit rates in an attempt to keep their own yield-curve steep. This ultimately becomes an issue for deposits as depositors can get a growing yield spread relative to deposits in safe alternatives such as T-bills and money market funds.

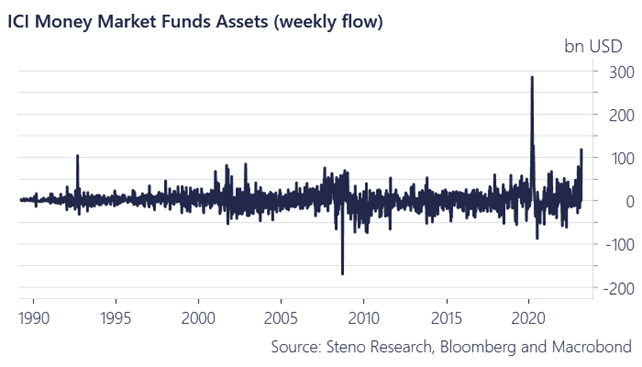

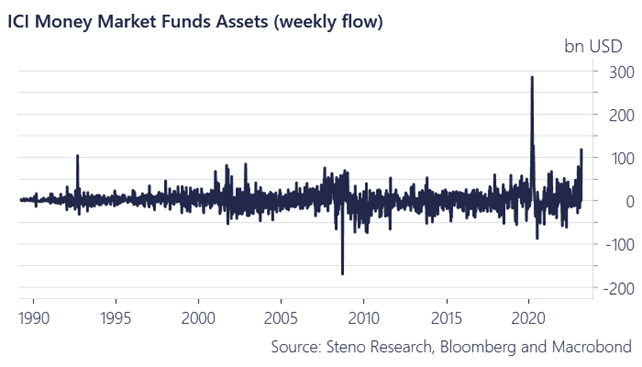

This week marked the most extreme inflows to money market funds outside of the Covid-shock in March-2020, which is a hint that deposit flights continue at almost record pace in the US.

Chart 4. Money market funds see massive inflows

Jannet Yellens slow motion traffic accident in Congress in response to very valid questions from Republican James Lankford has not helped the issue as she essentially pulled the rug from under small- and medium sized community banks by hinting that >250k deposits are not safe outside of systemically important banks. The flight from small banks will accelerate consequently unless a nationwide FDIC guarantee is issued also for larger deposits.

This is the first step towards a complete Europeanisation of US banking, which is NOT what JPM and Citi should hope for. If the system ends up with only few but enormous systemically important banks (as in several European countries), harsh regulation and weak returns follow. Banking stocks in the US have never looked less attractive than right now.

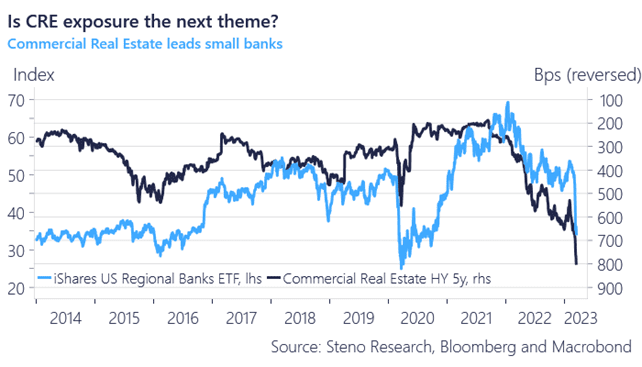

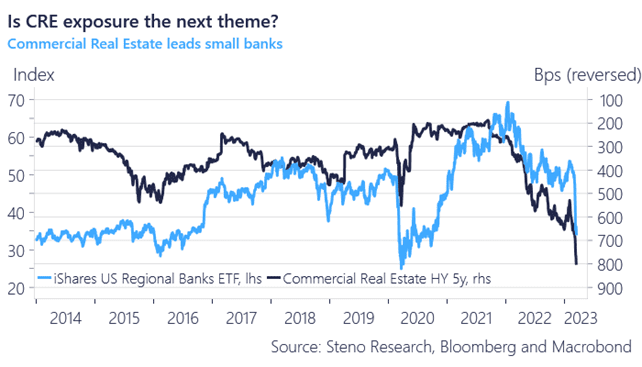

Chart 5. Regional banks follow CRE HY spreads

Smaller banks may now have the opportunity to secure 1yr lending at the Fed against bond-collateral at par, which was a first and very needed step from the Fed to ensure that community banks are able to meet deposit flights. It also effectively ensures that USTs regain their strength from a collateral perspective after a very shaky autumn with blood on the streets in US Treasury markets.

The issue is that liquid markets move ahead of illiquid markets. We have been banging the drum on a 20-25% drawdown in US (and global) housing and we are even more concerned about Commercial Real Estate (CRE).

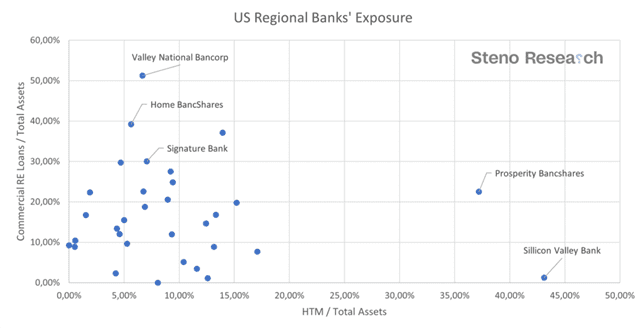

80% of lending to CRE rests on the balance sheet of <$250bn banks and some of them have 30-40-50% of their total exposure towards CRE.

A few of the worst cases are highlighted in the chart below, but otherwise you can find ALL about both the European -and US banking sectors, balance sheets and liquidity ratios on our live-blog on the banking crisis, which we will continue to update through next week.

Chart 6. Here are the banks to worry about now

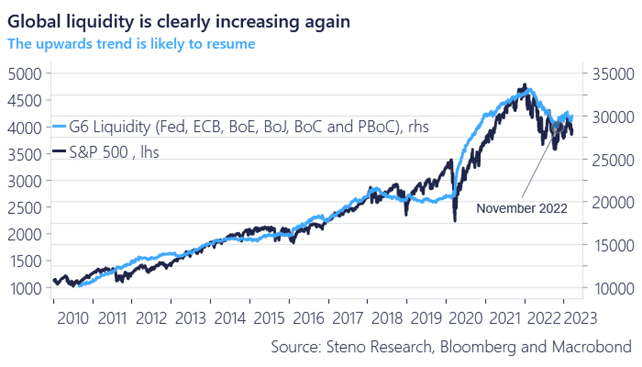

Meanwhile, global liquidity has started increasing again as also the Fed balance sheet now increases in size due to the increased usage of lending programs. Is this QE again? Not really, but it is close to. In QE you remove duration heavy assets perpetually from the market, while these new lending programs remove them temporarily.

Should counter-parts (small/medium-sized banks) go bankrupt or struggle to pay back the loans, then this will turn into an outright QE-program mechanically (since the Fed will keep the ownership of the bonds). That is ultimately a fair assumption, why it is probably fair to say that QE is effectively already back!

Will equity markets party due to added liquidity? Added liquidity does not exclude short-term selloffs, but the risk/reward for long-term investors in adding to Tech/Consumer Discretionary exposures is getting better and better these weeks, also as the progress made on AI (via ChatGPT4 and Palm-E) is outright stunning.

Chart 7. Global liquidity is improving markedly

The underlying issues around deposit flights are not specific to the US. Deposit flight is already a thing in Europe as well due to the inverted yield curve, which has been met by artificial attempts to create steep internal funding curves in the European banking system as well. Since the ECB has lagged the Fed in this hiking cycle (as per usual), the European banking system will also lag the US banking system in relation to the deposit flights.

Don’t rule out that other banks than Credit Suisse are about to suffer from deposit flights. The trend has just started unless the ECB re-steepens the curve asap.

Chart 8. The European Banking system suffers from the same issue as the US banking system

How do we position for this?

In equities:

We like a long equity tilt due to the added global liquidity (mainly driven from China/Japan) and prefer to play it via a position in Consumer Discretionary and/or Tech.

If you can stomach short-term volatility, then we find the current juncture attractive to invest from. Short-term investors should have VERY limited risk exposure in equities outside of in Tech/Discretionary.

Banking stocks and broader indices are likely to suffer in coming months.

We also continue to like exposure to China-linked countries such as Germany, Chile, Mexico, and Poland.

In rates:

We closed our rates flatteners on Monday and expect the hiking cycle to be more or less over. We find value in 1) buying 2yr Treasuries with an arm and a leg and 2) steepen the curve between Z3-Z8 in Eurodollar.

In FX:

We remain short USD/JPY and NZD/USD, while we decided to close our EUR/HUF shorts on Wednesday. JPY is the best bet on earth right now in our view.

In Commodities:

No commodities outside of Gold will thrive in the current environment. We have closed our Copper longs on Wednesday.

5 Comments

not a comment but administrative question:

I was not asked to create a password when I signed up?

will a password be needed?

Our support team will contact you

Andreas, do you have a stance on Eurobonds here?

I’m unable to allocate funds to US fixed income – does the same logic apply to bunds for example?

I am tempted to say yes, even if my conviction is less strong

You think silver is no good too, just gold?