Steno Signals #39 – Time to figure out who’s naked

“If you suppress the exorbitant love of pleasure and money, idle curiosity, iniquitous pursuits and wanton mirth, what a stillness would there be in the greatest cities”

– Jean De La Bruyere

Happy Sunday friends and welcome to our flagship editorial.

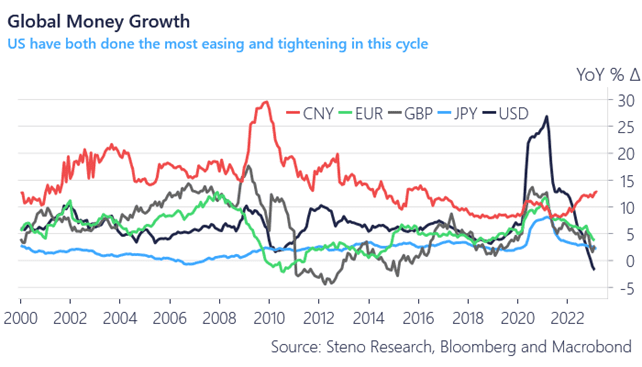

It’s time to figure out who’s (swimming) naked and the best way to gauge that ahead of the market is to look at money growth trends. China is back wearing clothes, while we Westerners are now running around naked (again).

What a week… Flows started turning ugly on Thursday/Friday with sizeable selling in SPY and buyers returning in bond space. Is Silicon Valley Bank the “credit event” that bears have been waiting and waiting and waiting for in this cycle? It depends a lot on the response from monetary/fiscal authorities.

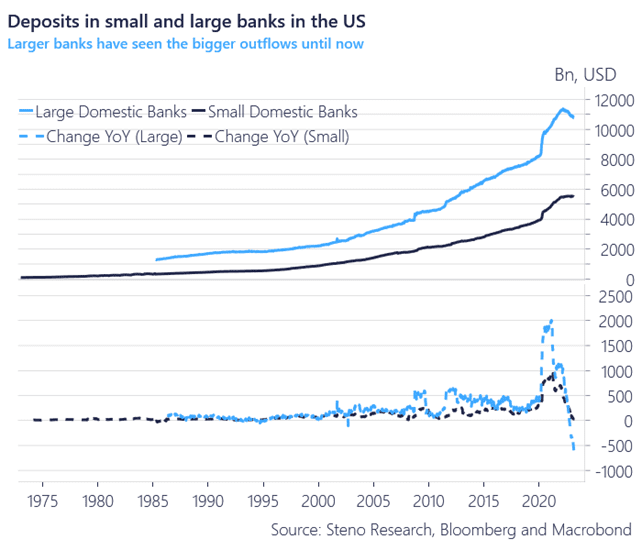

Around $5500bn worth of deposits are still parked in “small domestic banks” (threshold <$250bn in assets). Outflows have so far been material from large banks (towards for example bills), while deposits in small banks have been stable until last week.

If depositors of the SVB are not fully recovered in a manufactured deal as of Monday, it clearly raises the risk of a further deposit flight from small to large banks, no matter whether the SVB was driven as a fixed income casino (in hindsight). SVB is/was not like the others because a prudent bank hedges interest rate risks in the bank book. SVB did not, which is outright bizarre.

My base-case is that SVB will be sold in a partially “guaranteed” deal, which will alleviate some of the stress short-term. I will be watching Janet Yellen on “Face The Nation” 10.30 Eastern (16.30 CET) to see what she’s got up her sleeve.

Chart 1. Deposits in small- and large banks

We already see how First Republic Bank suffers from outflows and other banks may be vulnerable as well unless the authorities decide to back-stop/guarantee depositors.

It is though like everyone have forgotten that everything is about money. Money growth is NEGATIVE in the US for the first time in many decades, which ultimately means that deposits disappear. It is very easy to run an idiotic business model during times of extreme money creation, while negative money growth always reveals who’s swimming naked.

The SVB was clearly swimming naked without any duration hedges of the bond book, but the risks of contagion to the interbank market is relatively low as the interbank lending market has more than halved in size since the GFC. The big issue is if other small domestic banks will be faced with bank runs in coming days. The authorities will decide on that, but from everything I hear from contacts in the US, we should expect a deal sugarcoating the risks.

Chart 2. Money growth in various currencies

Silicon Valley Bank is nothing but a symptom of years of excess money growth and it is now time to figure out who else is swimming naked. Money growth is negative, and idiots only survive in times of excess liquidity.

0 Comments