Steno Signals #110: Run for the hills? Not so fast..

Happy Sunday from Copenhagen!

My apologies for the slightly later release of the Steno Signals Sunday editorial. We are in the process of moving, making Sundays a work-at-home day instead of a woke-from-home day!

It’s been a tricky few weeks for high-beta risk assets, and with high-level voices such as Bill Dudley calling for imminent rate cuts, we are at the stage of the cycle where many people are getting scared of the equity/high-beta momentum.

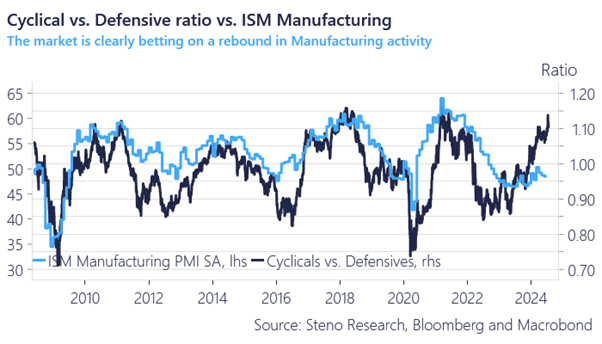

It is admittedly true that “cyclicals” have front-run a re-ignition of economic momentum to an extent that speaks in favor of a rotation in equity markets. It is also fair to assume that equity markets have priced in a lot of good news from the business cycle, while the rates market is still stuck in cutting mode. But is it really time to run for the hills just because of that cocktail?

Rather, it is time to rethink the strategy here, and I will try to do so below.

Chart 1: Cyclicals have been front-running a rebound in the economy

Equities are showing some signs of exhaustion, and it seems like there is still impending recession fear hidden beneath the surface. Is it time to run for the hills, or time to rethink?

0 Comments