Steno Signals #103: A blood-bath in metals in July!?

Happy Sunday from a windy Copenhagen!

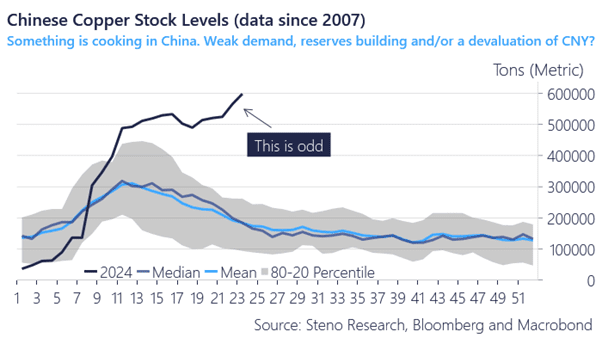

We’ve been yammering about the copper buildup on Chinese exchanges for months. Was it a strategic decision to hoard copper reserves? Were the Chinese waiting to offload this copper until the CNY devalued, or a result of the physical demand in the Chinese economy nosedived off a cliff?

We jumped on the copper speculation bandwagon earlier this quarter (with a stroke of luck), but also noticed some glaring cluster risks in this narrative. First off, if China really wanted to build up reserves, why isn’t the copper leaving the exchange(s)? Sure, they might be “sending a signal” to the world by keeping it there, but it also screams bearish vibes about Chinese end-user demand.

No matter how you slice it, the chart of Chinese copper stock levels on exchange doesn’t scream strong physical demand (see chart 1a). Quite the opposite, actually. There are only two explanations: 1) China is building reserves and, for some inexplicable flex, keeps it on the exchange, or 2) Chinese copper consumption is absolutely tanking.

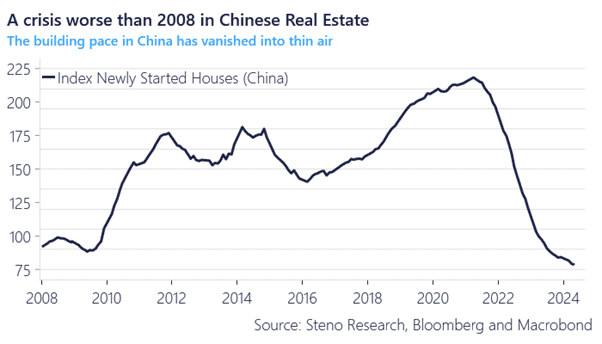

We’re starting to lean towards option 2), even if 1) makes sense… and let’s face it, the building activity in China isn’t bouncing back at all. The Politburo has moved on to other projects like solar and EVs, but construction activity is still in the gutter (see chart 1b). Remember, up to 30% of China’s copper consumption was tied to real estate activity as recently as 2022.

This medium-term bullish Copper narrative is vastly oversubscribed, especially among bankers and Macro PMs, in my opinion (I am looking at you mr. Andurand). More on the July blood-bath risks below…

Chart 1a: Why are the Chinese still building reserves of Copper on exchanges?

Chart 1b: No whatsoever rebound in Chinese construction

There is a material cluster risk in metals ahead of July deliveries and the consensus remains alarmingly upbeat in Gold, Silver and Copper. Here is why it could turn into a July bloodbath in metals.

0 Comments