Rotating EM Flows: From Japan to Emerging Asia

Welcome to the Emerging Market Series, this week covering the rotating capital flows away from Japan and its significance for China and Emerging Asia

Watch a condensated version of the key findings from this article on video:

Recovering from the ‘lost decades’ Japanese equities have been out of favor and continuously underperforming global benchmarks. For 2023 however, the Nikkei 225 actually outperformed the S&P 500, returning 28% vs. 24% respectively, and the euphoria around Japan returning to normalcy in terms of structural inflation, growth and its feasibility as an investment has continued into 2024 (Nikkei vs. SPX ≈ 15% vs. 8.5%).

But the reason for the strong performance can be attributed to more than the above. China has de facto been shut down and struggled to recover. Add to that geopolitical tension, lack of transparent governance, and regulation and a $9tn government debt largely collateralized in real estate, and you have the reason for the distaste for mainland China by foreign investors. FDI flows bound for Japan (and India) have seen a 2-sigma increase roughly netting those otherwise ending up in Chinese markets.

The case for a Chinese revitalisation is becoming increasingly stronger. Pro-cyclical trends are evident, industrial metals and materials are ripping (copper, HG1, up 3% on the day yesterday), and Emerging Asian FX and equity are broadly performing. Foreign direct investments in China seem to be picking up and further fueled by initiatives implemented or intended by local governments. Investments which Japan has largely been on the receiving end of these past years.

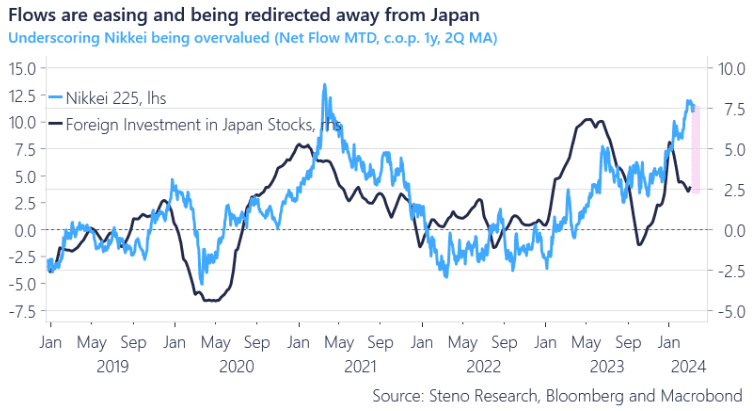

Chart 1: Fading Japan

Japan has reemerged as a feasible investment these last years, but is the driving force of this performance ebbing, as China returns to the table? A look at the relative winners and losers if China in fact is returning.

0 Comments