Macro Nugget: The CNY is STRONG versus peers. A devaluation is appropriate

The CNY is STRONG versus peers. A devaluation is appropriate

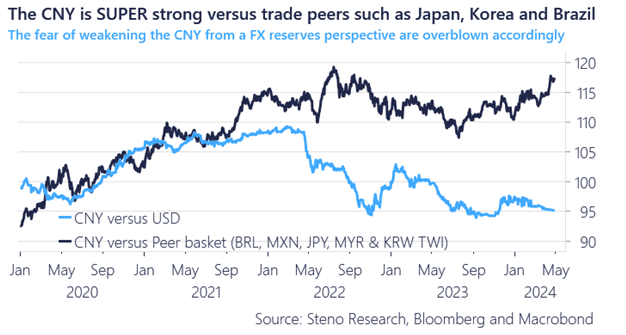

The CNY appears weak on the surface judging from trends in USDCNY, but if we assess the CNY versus a relevant basket of peers, it is up almost 20% on a trade-weighted basis since 2020. Allowing the CNY to weaken versus the USD would be a fair mark to market with actual global FX market pressures.

The strength of the CNY versus regional peers is an issue for the competitiveness of Chinese manufacturing and it alleviates the concerns that a managed devaluation will weaken the case for the Yuan as a reserve currency in the global south. If anything the PBoC has kept the CNY artificially STRONG during the last year or two. Peers won’t have a case if they blame China for currency manipulation.

Moreover, USDCNY has lost significance as a bellwether for Chinese exports given the weakening trade ties in recent years.

Want to know more reasons for why a devaluation is appropriate? Then find more here

0 Comments