EM Watch: Why China is trying to wreak havoc on your Gold longs

Welcome to our Weekly EM editorial.

In light of a likely Fed cutting cycle commencing in September, we will analyze why this cycle is anything but ordinary and how the EM price cycle may disrupt standard playbooks on trading a US cutting cycle.

Key Takeaways:

- Gold is likely to perform (much) worse than during a typical Fed cutting cycle.

- China is actively trying to cool down the gold market.

- The EM inflation cycle is indicative of what’s upcoming in DM markets into 2025.

- The Copper to Gold ratio is a screaming “buy” given this context.

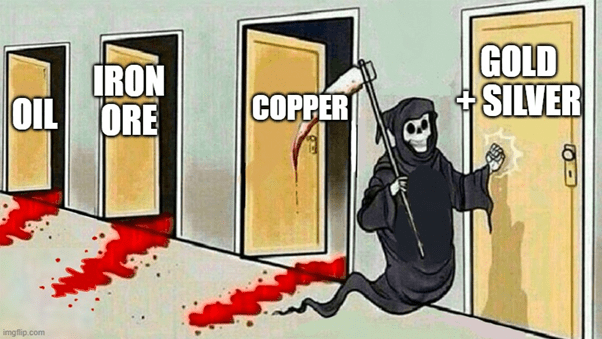

“If you cannot show it in a meme, then it’s not true.” That is our modus operandi at Steno Research. After the Chinese cycle deflated the popular oil, iron ore, and most recently copper bets, it seems like precious metals consensus longs are next in line.

The Fed looks likely to commence a cutting cycle in September, but can we use the typical cutting cycle playbook in EM- fixed income and Commodities? China is (potentially) wreaking havoc with the playbook!

0 Comments