EM Watch: Is the Chinese copper demand down 40%?

Welcome to our weekly EM and Metals editorial.

It’s hard not to talk about China again this week, given the importance of the metals trade for global inflation expectations. Our live assessment of the Chinese recovery continues to paint a stalling picture in Real Estate, exemplified by the physical copper demand being on the edge of a precipice, while the pollution based metrics hint of a continued surge in industrial production into June. Selective China exposures continue to make sense.

The developments in Lat-Am central banking are also interesting, as the market has front-run a hawkish pivot in conjunction with the re-inflation seen in the Americas in recent months. Meanwhile, Mexico (and to a certain extent Brazil) remains well-equipped to capitalize on the faltering US-Sino trade ties.

Key-take aways:

– Lat-Am currencies remain attractive despite recent weakness and we continue to lean towards higher MXN & BRL interest rates 1yr forward.

– The China recovery bet is overcooked and markets now align with the 5% GDP target again, which looks gullible given that the consumption of Copper (and other resources) is on the floor in China. You can remain selectively long China, but not in Real Estate (and proxies such as Copper) yet.

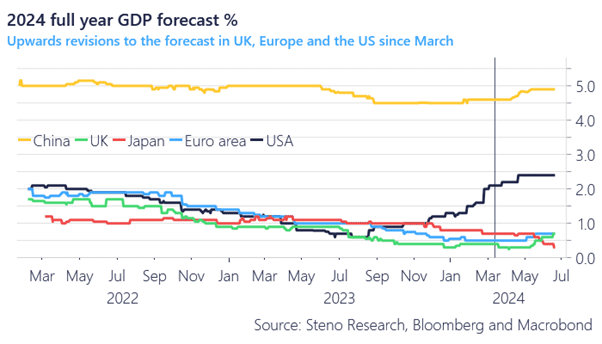

Chart 1a: Markets now see Chinese GDP at almost 5% after a bullish re-adjustment

The Chinese apparent copper consumption is absolutely on the floor, while the copper market is turning bid again. Is the Chinese consensus getting too upbeat again? And how will it market in the West during the summer?

0 Comments