EM Watch: China is preparing something BIG!

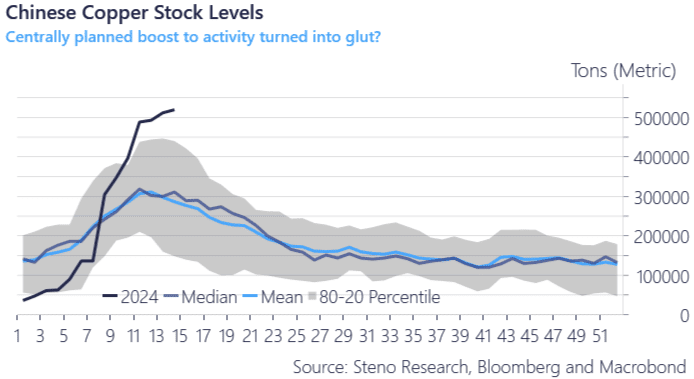

The below chart of ours have made the rounds in recent days and weeks as China seems to be preparing for something big given the heavy restocking efforts in Copper space. As the price trends are diverging in copper versus steel and iron ore, the strategic initiatives of China are becoming increasingly evident in price action across the commodity complex, but we are yet to fully understand and accept the ramifications for global rates.

We have read plenty of bad takes on why China is building up copper reserves and the most obvious reason seems to be neglected by many. China is building massive capacity within green tech and especially European markets will be flooded with subsidized Chinese Solar Panels, EVs and Wind Turbines through 2024/2025 as China has brilliantly secured a strong supply chain, which makes it hard(er) for European companies to compete.

Chart 1a: Chinese copper stock levels

The strategic shift from Real Estate to Green-tech manufacturing in China is very evident and it will likely impact Europe to a much larger extent than the US. Counterintuitively, it means that two of the strongest inflation hedges stem from China and Mexico simultaneously. Here is why!

0 Comments