EM by EM #40: Chinese Promises and Mexican Traps

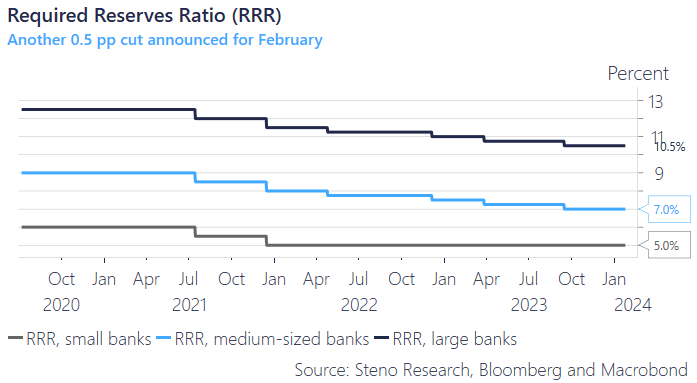

Not how that last sentence has essentially proved to be the first pawn that the Chinese leadership has chosen to move, which implicitly proves that the 2023 preferences are still intact: The Exchange rate matters, and the capital flight needs to be backstopped and that remains the priority vs easing the burden on the rate-sensitive sectors that are currently dragging the economy down. The reduction in the Reserve Requirement Ratio (RRR) injects liquidity into the financial system while maintaining a level of stability in the fixing process. This marks the deployment of the first tool in the anti-crisis arsenal

Chart 1: China RRR

As we conclude a busy midweek with loads of matter to digest in a global macro we will this week attempt to make an odd synthesis between the recent events in China its importance for price action and how we look at it going forward and Trump’s success in New Hampshire and how we are currently framing the 2016 campaign in the context of the EM space

0 Comments