Something for your Espresso: Wyoming is not only full of cowboys

Still no true stabilization of markets as the stalemate just south of 7.30 in USDCNY remains the key battle to watch. We find Jackson Hole to be a potential catalyst for a new test of 7.30 but have noted how the consensus ahead of Powells appearance at the conference has gotten increasingly USD-hawkish.

This year’s theme at the Jackson Hole conference in Wyoming is “Structural Shifts in the Global Economy” and oh boy it seems like we have had plenty of those over the past two years.

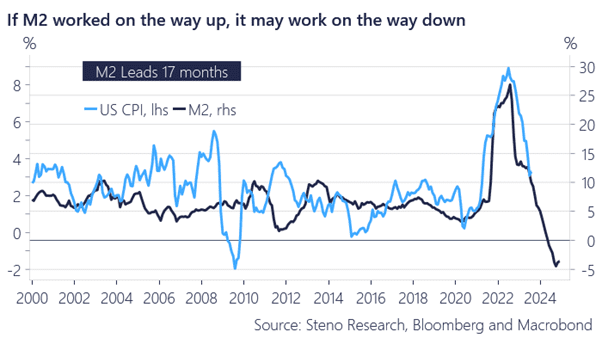

Volatility in the broad money base (M2) is back with a vengeance and central banks have to dust off their 1970/1980s models on the connection between M2 and price inflation. if they had trusted M2 growth as an inflation guide, we would have avoided QE amidst already above target inflation as in 2021/2022.

M2 currently points clearly to the downside for 2024 and yet no one dares to trust that signal either. Do you?

Chart 1: M2 volatility is back with a vengeance

How many hawks and doves will arrive in Wyoming for the Jackson Hole conference? The doves have received a perfect excuse from China and the PBoC will hope and pray that Powell announces an explicit pause, but he won’t.

0 Comments