Something for your Espresso: Wen taper?

The Federal Reserve meeting later is obviously the most important event of the day.

Market pricing: March-meeting (-0.01 bps) and June-meeting (-17 bps)

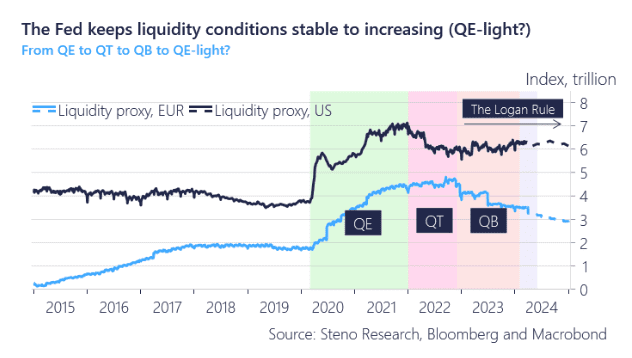

The meeting is more about QT tapering than the timing of the first rate cut, in our view.

Markets have repriced the Fed to an extent where the dot plot seems outdated and a re-affirmation of three expected cuts this year would actually make for a dovish read by now. The risk is (obviously) tilted towards only 2 cuts in the dot plot (September/December), but we also expect the Fed to be interested in cutting for the first time well in advance of the election (September the very latest) to avoid a discussion on political interventionism.

Loretta Mester has discussed publicly whether the Fed should consider increasing the “longer-run” dot in the dot plot from 2.5%. That would be a major signal, but the consensus is NOT there yet for such a move.

Seasonal patterns in the TGA and bills issuance will keep the ON RRP above depleted levels for March and April, while the next wave of outflows from the facility should be expected in May/June. The Fed is probably aware of this pattern, leaving a June taper of QT as the most likely timing of the implementation.

As per usual when discussing balance sheets, the announcement factor is often stronger than the flow factor, meaning that an announcement of a June taper today, will likely be risk-positive, on top of the risk picture tilting towards the dot plot being more dovish than market participants currently expect.

Chart 1: A QT taper will keep liquidity conditions benign in USDs relative to peers

We suspect that the market will care more about QT tapering than the exact timing of the first rate cut from the Fed, allowing for a decently dovish take-away from the meeting today.

0 Comments