Something for your Espresso: Waiting for a German restocking cycle amidst a shutdown

Morning from Europe.

A relatively quite start to an important week in global macro. Will the US Federal Government shut down and will German Manufacturing prospects rebound? Follow along below.

The conclusions in short:

– The German IFO Survey will reveal whether to go long Nat Gas or not this week. Watch the Chemicals sector as the best cyclical gauge in Europe.

– The USD long is not a good risk/reward trade ahead of a week with large shutdown risks. The deadline for US policy makers is less than a week away with very little progress.

– The US Macro picture is walking a tightrope and might catch down towards peers due to a weakening service sector

– Energy remains a strong performer right until (and even into) the actual recession

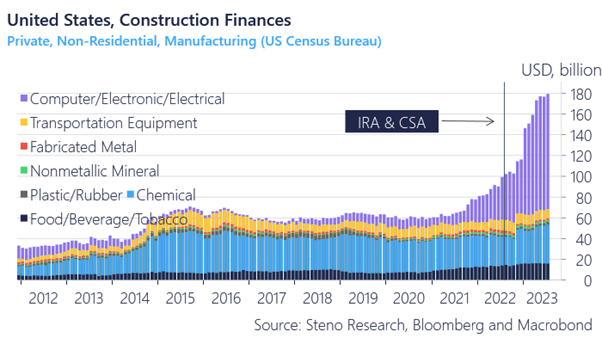

Chart of the week: US Manufacturing has saved the whole construction sector in 2023

A crucial week is ahead of us in global macro as the only remaining bastion in the global economy may be heading into a shutdown. Meanwhile, we are watching for signs of an emerging restocking cycle in Germany.

0 Comments