Something for your Espresso: Unions paving the way for Ueda

Morning from Europe!

The Bank of Japan is slowly but surely getting what they want. Rengo reports >5% wage growth in total (base + variable), which is exactly what policy officials were hoping for. In sharp contrast to the Euro zone, policy officials actually cheer on wage hikes in Japan as they see them as a crucial part of forming a “virtuous wage-price cycle”, while such a cycle is seen as a clear negative among ECB members.

It now looks increasingly likely that these “bluechip” wage deals will trickle down in Japan and Toyota has also strongly urged suppliers to increase wages to an extent that exceeds what we have been used to in recent decades.

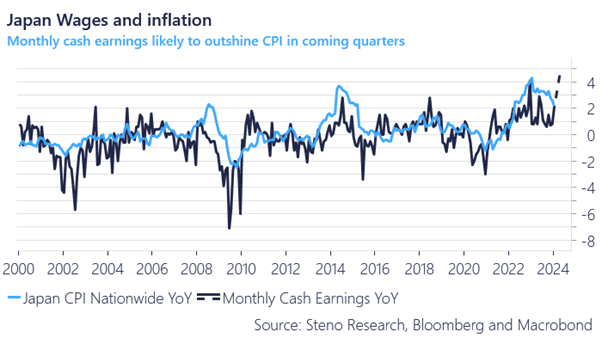

The wage momentum leaves an interesting gap between CPI and wage growth in coming quarters, which is probably likely to pull the rug from under the momentum among Japanese large caps. When they are faced with input cost increases from suppliers, they are likely going to get squeezed on their own margins short-term.

We continue to bet on BoJ policy action already next week via shorts in CHFJPY, but we don’t see strong investment cases in Japan on the long side, rather on the short.

Chart 1: Wages > inflation in Japan in Q2/Q3?

>5% wage gains for the Rengo union members in Japan, which paves the way for policy action from the BoJ. Meanwhile, the PBOC refrained from cutting. Possibly as rate cuts are off the table in the US given the PPI developments?

0 Comments