Something for your Espresso: Time to wake up for the CCP?

Morning from Europe.

Awful numbers from China with both exports and imports down more than expected but the data is also really interesting from a stimulus perspective.

Net exports are up (exports down less than imports), which is a net/net positive from a GDP perspective. On the surface that speaks against material stimulus from the authorities, but a sharp drop in imports is never a good sign.

The impact on the numbers (measured in USD) from a weaker Renminbi is also evident and it should increase the appetite for a stabilization of the Yuan here.

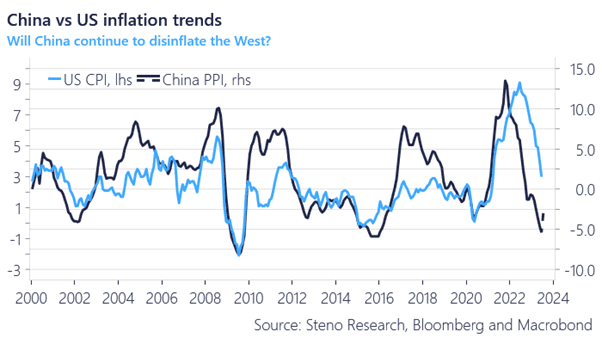

The bottom-line is that it leaves consumer deflation as the likely outcome for China short-term and they will of course try to export that (via the FX and goods channel). Goods prices will continue to drop, but China is less important for the goods supply chain than 2-3 years ago.

Let’s see if the below gap between the US CPI and the Chinese PPI will close from below or above.

Chart 1: China is now in deflation in both PPI and CPI terms…

Nothing out of China supports the China bulls and the bears are loud again this morning, but is the data now getting bad enough for the CCP to put the pedal to the metal? Meanwhile the BoJ is caught between a rock and a hard place.

0 Comments