Something for your Espresso: The one on Houthis and Ueda

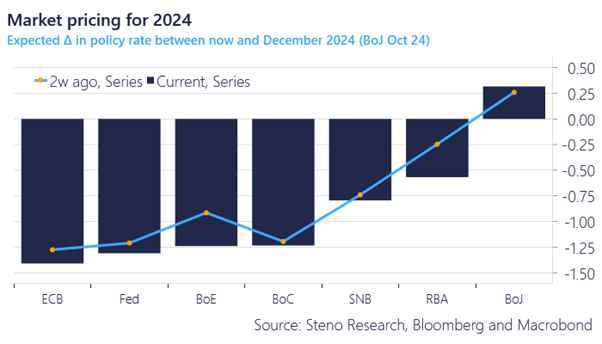

Morning from Europe where the ECB is back in the dovish front-seat in 2024 market pricing. The ECB easing is back loaded relative to the Fed, and the market is not convinced of March-2024 action in Frankfurt with a clearly below 50% probability priced in for a cut. The notion is currently that the Fed will “inaugurate” the cutting cycle and that peers will follow (with more easing).

Meanwhile, the BoJ is one of the very few central banks priced to hike interest rates in 2024. There were no immediate hints of action from the BoJ overnight and those who had hoped for a policy hint ahead of the first quarterly meeting with updated projections in January are left disappointed.

We still see April as the most likely timing of a hike, in case the BoJ delivers at all. Moreover, we still cannot get our eyes off the RBA pricing in relative terms and we entered AUD duration positions lately as a convergence bet for 2024.

Chart 1: Market pricing for 2024

The Bank of Japan is not really warming up for action in January, which is the next meeting with an updated view on the “outlook for economic activity and prices”. Meanwhile, the Houthis are trying to distort global supply chains.

0 Comments