Something for your Espresso: The most hawkish BoJ in decades?

Morning from Europe

The ambiguous BoJ strikes again. It is very unclear what the new flexibility in the YCC program actually means, other than 1% not being a crystal-clear line in the sand any more.

A few highlights from the BoJ communication:

1) 10yr YCC cap is no longer strictly 1% and the BoJ adds flexibility by “nimbly” conducting market operations around 1% instead of at a fixed rate operation

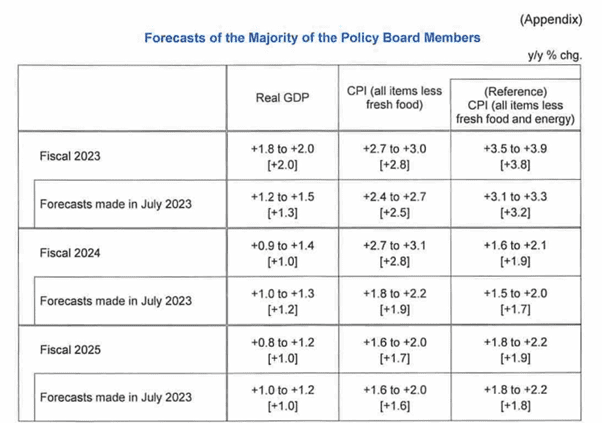

2) The inflation forecast was increased to 2.8% in BOTH 2023 and 2024 for CPI ex fresh food (yes, you heard them right). That is an increase of 0.9%-points in 2024!

For the CPI ex fresh food and energy, the forecasts are 3.8% and 1.9% for 2023 and 2024.

Chart 1: The new forecasts from the BoJ

The Bank of Japan opens the door for >1% 10yr bond yields alongside a large revision of inflation forecasts and yet the JPY weakens again – exactly as we anticipated. Meanwhile, the US Treasury issuance bazooka was nowhere to be seen, or was it?

0 Comments