Something for your Espresso: The deposit flight continues

Good Morning.

The deposit flight continues and we eagerly awaited the final confirmation of it as the weekly data on the Fed balance sheet and money market flows was released yesterday.

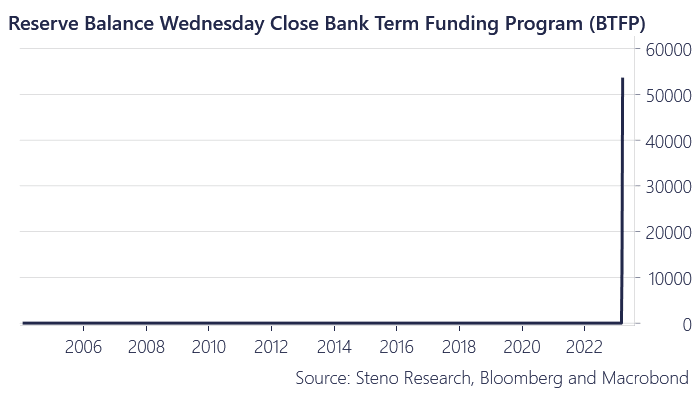

The BTFB (the new lending program) is now running at >50$bn, while also the FIMA-repo facility for foreign central banks was tapped to the maximum by one counterpart. These are continued signs of deposit flight and/or liquidity stress in the USD system and the Fed balance sheet is swiftly en route for new all-time highs at this pace. The Fed is likely to accept that QT is now being countered by a range of crisis instruments allowing liquidity- and asset base to increase despite the intention to bring it down.

This is ultimately USD bearish (and risk asset positive), but we still fear a dash for USD cash in April/May before improving impulses.

Chart 1. New spike in the BTFP lending

Both weekly and daily indicators of deposit flight continued to show signs of money leaving the banking system for money market funds, while banks continue to underperform. Will the Fed come to accept new all-time highs for the balance sheet?

0 Comments