Something for your Espresso: The Chinese cutting cycle is back on fire

Morning from Europe.

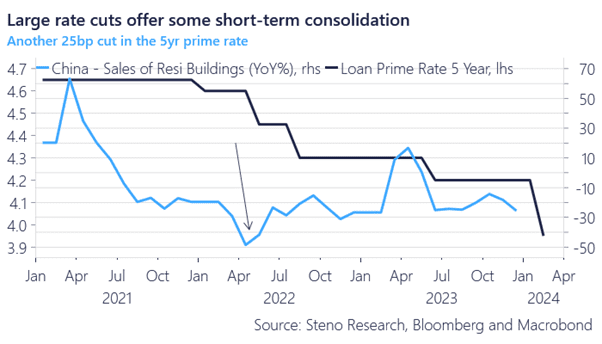

The Chinese authorities delivered a 25bp cut to the 5yr prime rate, which is the largest sequential step taken to combat the Real Estate crisis via the rates instrument so far. Steps of 10-15bp have been preferred through 2022/2023, and this major dovish hint holds the potential to lead market-based rates in the belly of the Yuan-curve below 2020 lows.

The PBoC have so far refrained from large rate cuts, probably as the risk of devaluating the CNY too fast was too high, but it seems like the recent stability in the 7.10-7.20 range has increased their appetite.

This is a strong hint to get long the USD versus CNH again, and the other market based release-valve in USDJPY is also trading up this morning as a consequence.

Chart 1: A 25bp cut for the first time in this cycle in China

The Chinese authorities have stepped up their cutting game again, which may offer some short-term consolidation if continued. The spillovers to CNY, JPY and goods prices will be clear as well.

0 Comments