Something for your Espresso: Steep, steeper, steepest?

Morning from Europe.

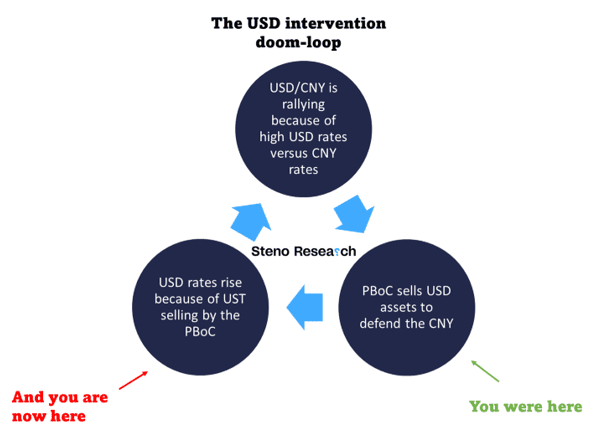

We have recently highlighted how the risk of the PBoC, the BoJ and the CBI entering “intervention territory” in FX terms at the same time, would constitute a risk for US Treasuries and it seems like we are now stuck in the middle of that exact mess already.

The one-sided Asian intervention against a strong USD, embedded leads to USD asset selling in Asia, which may ultimately fuel further fundamental upside for the USD via the yield spread channel.

The Asian FX doom loop is alive and kicking.

Chart 1: The one-sided USD intervention doom-loop

The curve steepener remains the best risk/reward trade in global macro as the Asian doom loop now adds to steepening pressures. With the PBoC, the BoJ and the CBI in intervention territory, should we expect further pressures?

0 Comments