Something for your Espresso: Soft-flation from Europe

The ECB is officially on pause after last week’s meeting and for good reasons given current inflation developments in Europe. The early evidence from Brandenburg and North Rhine Westphalia suggests that EUR-flation will print 0-20-0.25% below consensus (and the ECB forecast as well). Good news for EUR duration bets as we entered last week.

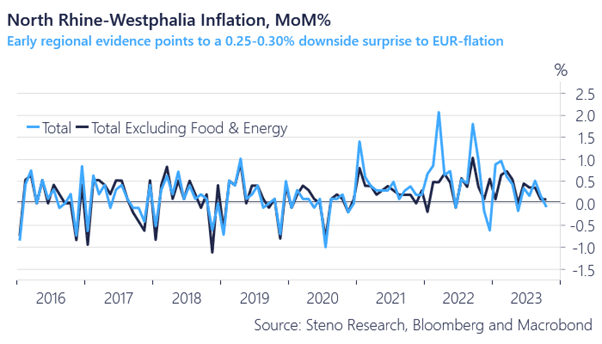

This morning the print from North Rhine Westphalia came in at -0.1% MoM, which is clearly below typical seasonal patterns. North Rhine Westphalia is typically the most important regional gauge for inflation, which is why this is a very strong dovish signal for broader European inflation.

Chart 1: Dovish regional trends in prices in Germany

Early regional evidence suggests that we will see a dovish surprise to the EUR-flation numbers this week as we forecasted. Will the Fed and the BoE be convinced of similar dovish inflation trends when they meet?

0 Comments