Something for your Espresso: Producer deflation and a cyclical rebound

Good Morning from Europe.

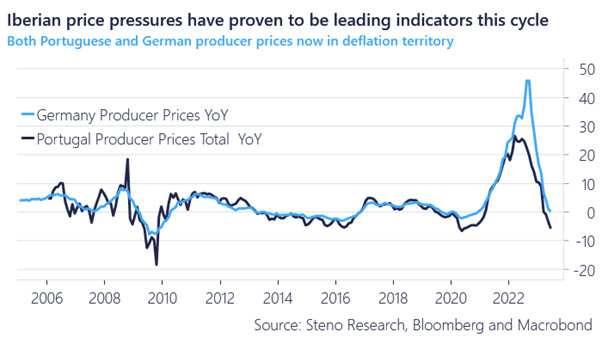

The disinflation or do I dare say deflation in European producer prices continues. Both Portuguese and German PPIs are now (almost) in deflationary territory and the strength of the overall European economy / consumer will now decide to which extent this will be passed through to consumers. The German PPI for June printed at -0.3% MoM and 0.1% YoY.

If the CPI remains in >2% territory given these PPI numbers, it is hard to construct a negative narrative for equities as margins will gain from such a scenario.

Chart 1: Deflation in European PPIs

Most recent trends point to a combo of outright deflation in the producer leg paired with short-term cyclical optimism. It almost sounds too good to be true given what we have been through. Hello, Goldilocks (for the time being).

0 Comments