Something for your Espresso: It’s either recession or restocking from here

Morning from Europe

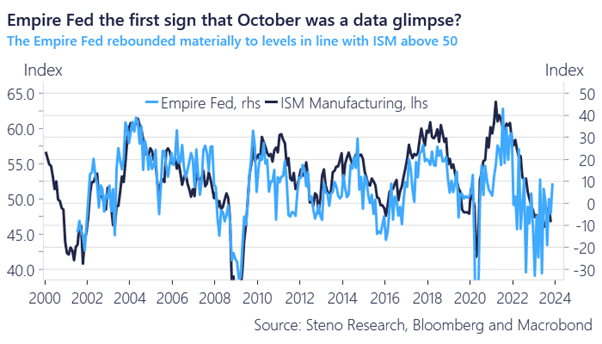

October data has been soft both in inflation and growth terms, driven among other things by lower prices on retail transportation fuel, but was it all based on weak data quality? We are starting to convince ourselves that we will see a decent data rebound in both prices and growth gauges into year-end driven by seasonality and restocking.

The ISM Manufacturing printed just above 46.5 in October, but most indicators point towards a pretty decent rebound in November. The first regional survey was out yesterday and it rhymes with a bounce in the ISM Index towards year-end. Even if the Empire Fed survey is one of the weaker regionals in terms of prediction capabilities, it adds to the vibe that October was a data glimpse.

Chart 1: Empire Fed versus ISM Manufacturing

Most of the signals from our models hint that the weakness through October was a data glimpse and that 2023 will end on a strong seasonal note before a weak 2024. Either we are right or else recession is looming.

0 Comments