Something for your Espresso: Hide and seek with Biden

Good morning from Europe.

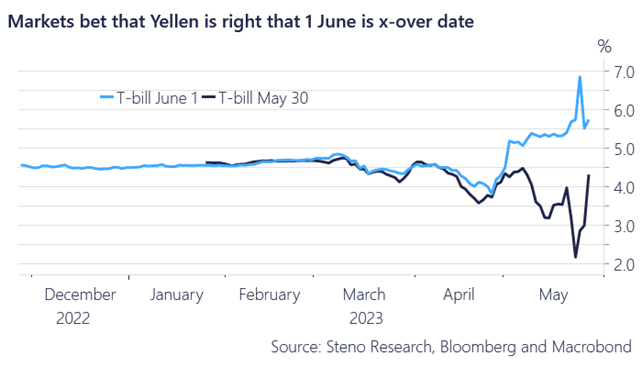

The debt ceiling stand-off continues, and we have admittedly been caught wrongfooted in our assessment of the rates positioning into the ultimate x-over date for the US Treasury. Front-end rates spiking 15bps based on a “base-effect” in initial claims is pretty telling of a uniform receiver positioning (bond longs) in USD rates.

If you pair that with a lack of clarity around the solution on the debt ceiling, front-end rates can go higher despite the pretty clear intention from the Fed to at least skip the hike in June. The x-over date is likely already early/mid next-week meaning that a (partial) shutdown of the US Federal Government moves closer and closer.

Yellen keeps referring to a x-over date first of June, while Goldman advocated for an ultimate x-over date 8-9th of June. Markets speak loudly. The x-over date is already next week.

Chart 1: Spread between June 1 and May 30 effective T-bill yield

Biden is allegedly planning to leave Washington for the Memorial weekend, which underpins the probability of our base-case of a shutdown and a prolonged debt ceiling stand-off. The TGA is now BELOW typical shutdown levels.

0 Comments